Business copier leasing provides a strategic way to access advanced office technology without the high upfront cost of purchasing. By leasing, companies can spread costs over time, preserving working capital for core growth initiatives.

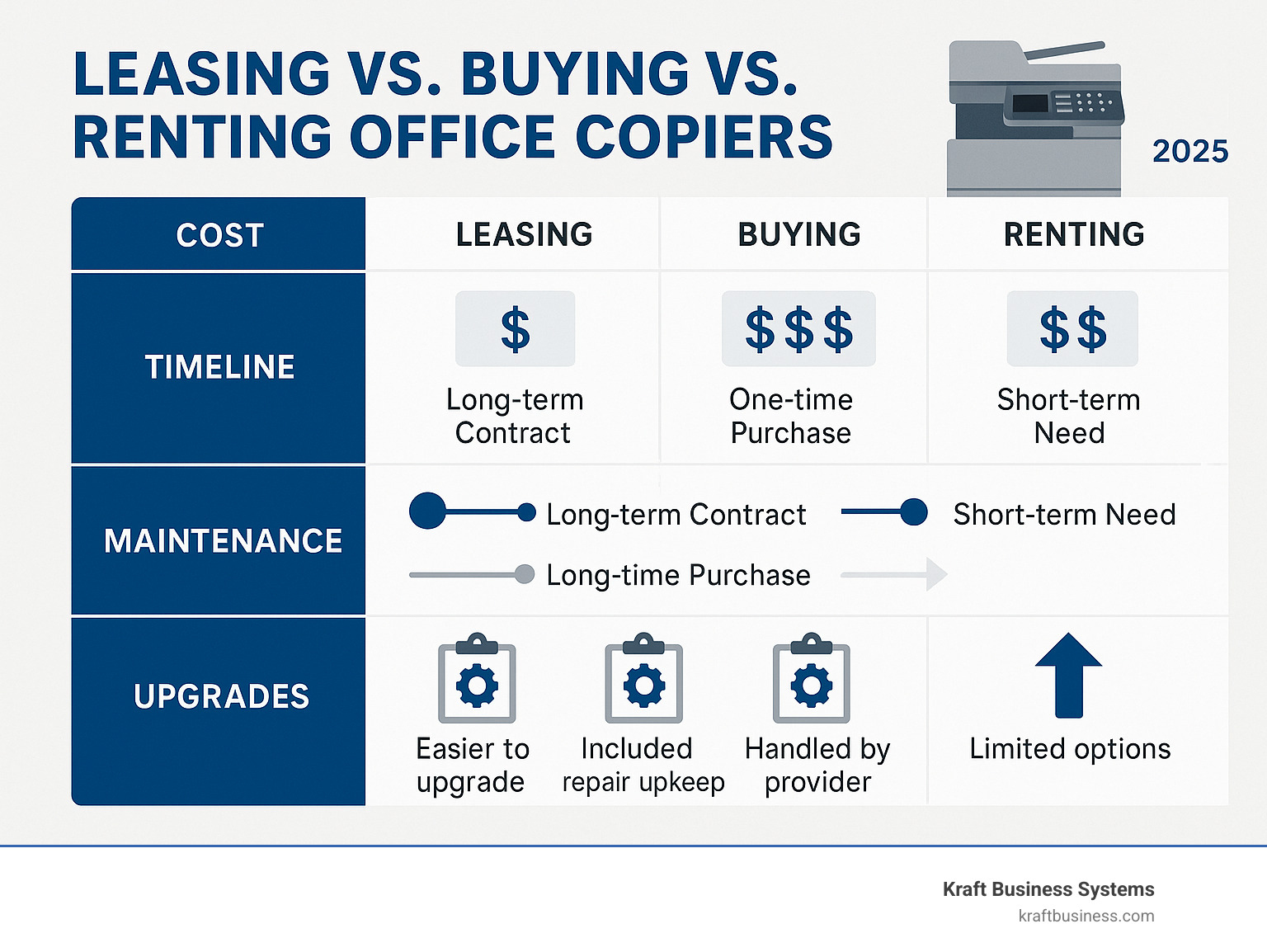

Quick comparison of your main options:

- Leasing: Lower monthly payments, maintenance included, easy upgrades, no ownership.

- Buying: Higher upfront cost, full ownership, responsibility for repairs, potential tax benefits.

- Short-term rental: Flexible for temporary needs, higher per-day costs, no long-term commitment.

The decision between leasing and buying is about strategic planning. Industry data shows that nearly 85% of commercial business copiers are leased rather than purchased. This is because leasing offers predictable monthly expenses, built-in maintenance, and the flexibility to upgrade as technology evolves.

Key advantages of leasing include preserving capital, predictable expenses, access to the latest technology, and bundled maintenance. However, leasing isn’t for everyone. Companies with strong cash flow intending to use equipment long-term may find buying more cost-effective.

This guide covers the costs, contract terms, and decision factors to help you choose the best option for your business.

Relevant articles related to business copier leasing:

Leasing vs. Buying: A Head-to-Head Comparison

Choosing between leasing and buying an office copier depends entirely on your business’s financial strategy and operational needs. Let’s break down the key differences to help you decide.

| Feature | Leasing | Buying |

|---|---|---|

| Upfront Cost | Low or none | High initial investment |

| Long-Term Cost | Potentially higher due to interest/fees | Generally lower (no finance charges) |

| Maintenance | Often included in agreement | Your responsibility |

| Technology Upgrades | Easy to upgrade, avoids obsolescence | Risk of becoming outdated |

| Tax Benefits | Deductible monthly payments | Full purchase price deduction (Section 179) |

Business copier leasing primarily impacts your cash flow. By leasing, you trade ownership for flexibility and cash flow preservation. To assess your needs, consider if you prefer predictable monthly expenses over large capital outlays and whether you need to keep cash available for other opportunities.

Owned equipment is a business asset on your balance sheet, while leased equipment is an ongoing operational expense. Neither is inherently better; they serve different financial strategies.

Advantages of Leasing a Copier

Leasing offers cutting-edge technology without a major financial outlay, making it ideal for businesses that value flexibility.

- Lower Upfront Investment: Start with little to no money down, preserving cash for marketing, hiring, or inventory.

- Predictable Monthly Expenses: A fixed monthly payment simplifies budgeting and eliminates surprise repair bills.

- Maintenance Included: Service plans, often part of Managed Print Services (MPS), typically cover repairs, parts, and toner. When something breaks, you make a call, not a payment.

- Easy Technology Upgrades: Transition to newer technology at the end of your lease term, which helps you avoid equipment obsolescence.

- Preserves Working Capital: Keep cash free for strategic investments rather than tying it up in a depreciating asset.

Disadvantages of Leasing a Copier

Leasing is not without its drawbacks. Understanding them is key to making an informed decision.

- Potentially Higher Total Cost: Over the lease term, total payments can exceed the copier’s purchase price due to interest and fees.

- No Ownership: At the end of the term, you don’t own the equipment unless you exercise a buyout option.

- Contractual Obligations: Leases are typically non-cancellable, committing you to payments for the full term.

- Usage Restrictions: Many agreements have monthly page limits. Exceeding them results in overage charges.

- Early Termination Fees: Exiting a lease early can incur substantial penalties.

Advantages of Buying a Copier

For businesses with the financial resources, buying offers distinct advantages.

- Lower Long-Term Cost: Once paid for, there are no more monthly payments, reducing long-term expenses.

- Full Ownership: The equipment is a business asset that you control completely.

- No Ongoing Payments: After the initial purchase, your monthly budget is freed up.

- Unlimited Usage: Print as much as you need without worrying about overage fees.

- Tax Deductions: The tax deductions under Section 179 may allow you to deduct the full purchase price in the year of service. Consult your accountant for details.

Disadvantages of Buying a Copier

Ownership comes with responsibilities that may not suit every business.

- Higher Initial Outlay: A substantial upfront investment can strain cash flow.

- Responsibility for Maintenance: All repair and maintenance costs are your responsibility and can be unpredictable.

- Risk of Obsolescence: Technology evolves quickly, and your purchased equipment may become outdated.

- End-of-Life Disposal: You are responsible for the proper disposal or recycling of the equipment.

Decoding the Costs: What to Expect Financially

Understanding the true cost of a copier involves looking beyond the initial price tag. It’s essential to compare upfront costs against monthly payments and watch for hidden fees in service contracts, cost-per-copy charges, and administrative fees.

Calculating the total cost of ownership is key. This includes base payments, service agreements, supplies, potential overages, and end-of-lease costs. This complete picture is what matters for accurate budget planning.

Typical Costs of Leasing or Renting

When you pursue business copier leasing, you’ll encounter several cost components that make up your total monthly payment.

- Monthly Lease Payments: These form the base of your costs, typically ranging from $100 for basic models to over $600 for high-volume machines, depending on the copier’s features and lease term.

- Cost-per-Click (CPC) Fees: These charges cover your actual usage (e.g., 1.5 cents for black and white, 8 cents for color). They usually include toner, parts, and basic service.

- Overage Charges: If you exceed your monthly page allowance, you’ll pay these fees, which are often higher than the base CPC rate. Accurately estimating print volume is crucial.

- Lease Initiation Fees: A one-time administrative charge to start the lease.

- End-of-Lease Shipping Costs: You are typically responsible for the cost of returning the equipment.

- Insurance Surcharges: Added if you don’t list the leasing company on your business insurance policy.

How Leasing vs. Buying Impacts Your Taxes and Cash Flow

Your choice between leasing and buying has different effects on your cash flow patterns and tax obligations.

With leasing, your monthly payments are operating expenses that you can deduct from your taxable income. This keeps cash flow steady and predictable.

Buying is a capital expenditure, tying up cash upfront but giving you a business asset. The Section 179 tax deduction can be powerful, often allowing you to deduct the full purchase price in the year you buy the equipment.

With ownership, you also deal with asset depreciation, as the copier’s value decreases over time. While you can claim depreciation, the resale value drops quickly.

The right choice depends on your financial priorities. If preserving cash flow is key, leasing is often best. If you have strong cash reserves and want to maximize long-term value, buying may be better. To see how these options compare for your business, use a calculator to compare lease versus buy scenarios.

Understanding Your Business Copier Leasing Agreement

Navigating a copier lease agreement requires understanding its key terms to avoid surprises. A business copier leasing agreement is a financial contract between your company and a leasing company, not the copier dealer. This means you are committed to the payments regardless of equipment or service issues.

Pay close attention to Service Level Agreements (SLAs), which define support expectations, and automatic renewal clauses, which can extend your lease if you don’t provide notice (often 90-180 days) before it ends. Most importantly, copier leases are non-cancellable agreements, obligating you to payments for the entire term.

Key Terms in a Business Copier Leasing Contract

- Lease Term Length: Typically ranges from one to five years (36 and 60 months are common). Longer terms usually mean lower monthly payments but a higher total cost.

- Fair Market Value (FMV) Lease: Offers lower monthly payments. At the end of the term, you can buy the copier at its current market value, return it, or upgrade. Most businesses upgrade.

- $1 Buyout Lease: Has higher monthly payments, but you can purchase the copier for $1 at the end of the term. It functions like a financed purchase.

- Included Copy Volume: Your monthly allowance for black and white and color copies. Exceeding this triggers overage rates.

Our consultants help businesses evaluate which IT solutions work best for their unique needs. More on IT Solutions.

What’s Included? All-Inclusive Service and Maintenance

One of the biggest benefits of business copier leasing is the comprehensive service and maintenance coverage, which is usually a separate agreement from the lease itself.

- Toner and Supplies: Automatically shipped as needed.

- Parts and Labor: Covered for all repairs, eliminating unpredictable costs.

- On-site Technician Service: A trained professional comes to your office, often by the next business day.

- Proactive Monitoring: Systems detect potential issues and can automatically order supplies.

- Help Desk Support: Provides immediate assistance for troubleshooting.

- Cybersecurity Considerations: Service often includes measures to protect your network. Learn more about cybersecurity for connected devices.

The Pros and Cons of a Business Copier Leasing Buyout

At the end of your lease, you may have the option to buy out the equipment. The main pro is the option to own the equipment, eliminating monthly payments. However, there are cons:

- The equipment may be outdated compared to newer, more efficient models.

- There is a potential for increased repair costs as the copier ages.

Often, the buyout price is substantial. Many businesses find that upgrading to a new copier on a fresh lease is more cost-effective than buying and maintaining an older machine. We can help you explore your options at lease expiry to determine the best path forward.

How to Choose the Right Copier and Provider

Choosing the right copier and provider is about more than just the machine; it’s about finding a partner who understands your business needs. At Kraft Business Systems, we help Michigan businesses make this decision by focusing on what truly matters.

First, assess your business needs by observing your daily print habits. Do you need high-volume black and white printing, or high-quality color for marketing materials? Do you require advanced features like scanning to email, stapling, or booklet creation?

Your print volume analysis is critical. A small firm might print 2,500 pages a month, while a busy office could need over 10,000. Miscalculating this can lead to expensive overage charges. Also, consider your industry’s required features, such as document security for law firms or HIPAA compliance for medical offices.

When evaluating provider reputation, look beyond marketing materials. Check their service response time and quality of customer support. A cheap rate is worthless if the provider is unresponsive when you have a problem.

Factors to Consider for Your Business

To find the right business copier leasing solution, evaluate your current and future business needs.

- Budget Considerations: Determine what you can comfortably afford as an ongoing operational expense.

- Monthly Print Volume: Track your actual usage for at least a month to get an accurate estimate.

- Growth Projections: If you plan to expand, your printing needs will grow. Plan for a machine that can scale with you.

- Need for Up-to-Date Technology: Decide if you need cutting-edge features to stay competitive or if proven reliability is sufficient.

- In-house IT Capabilities: If you lack a dedicated IT team, an all-inclusive service agreement with proactive support is invaluable.

Getting the Best Pricing and Terms

Securing the best deal requires a strategic approach.

- Request Multiple Quotes: This gives you leverage and helps you compare different offerings.

- Negotiate Equipment Pricing: The base price of the equipment affects your monthly payment, so don’t be afraid to negotiate.

- Clarify All Fees: Understand every cost, including monthly payments, per-page charges, overage rates, and end-of-lease fees.

- Understand the Service Agreement: Know what’s covered, the response time, and any exclusions.

- Read Customer Reviews: Look for patterns in feedback to gauge what it’s like to work with the provider.

The goal is to find the best value that keeps your business productive, not just the lowest price.

Frequently Asked Questions about Business Copier Leasing

Here are answers to the most common questions we receive from our clients about business copier leasing.

What is the main difference between leasing and short-term renting?

Think of leasing as a long-term partnership and renting as a short-term solution.

- Leasing is a financial agreement, typically for one to five years, for businesses needing consistent equipment access. It offers lower monthly payments and often includes service plans. You may have an option to buy the copier or upgrade at the end of the term.

- Renting is for temporary needs, like a conference or a seasonal project, lasting days, weeks, or a few months. It offers maximum flexibility with no long-term commitment but at a higher daily or monthly cost. There is no path to ownership.

Can I upgrade my copier in the middle of a lease?

Yes, upgrading is possible, but the timing is important. If you’re near the end of your lease (e.g., in the last 6-12 months), it’s usually straightforward to roll the small remaining balance into a new lease for an upgraded machine. If you’re early in your lease, the larger remaining balance will be rolled into the new payments, which can significantly increase your monthly cost. We can help you analyze the numbers to see if an early upgrade makes financial sense.

Are supplies like toner and paper included in a business copier leasing plan?

This is a common point of confusion. Supplies are covered by a separate agreement, not the lease itself.

- Your equipment lease covers the hardware—the physical copier. This is your fixed monthly payment for using the machine.

- Your service and maintenance agreement covers consumables like toner, drums, and other parts. It also includes labor for repairs and technician visits. This is typically billed based on your actual print volume (a cost-per-print).

Paper is almost never included in any lease or service agreement and must be purchased separately.

Conclusion

Choosing between business copier leasing and purchasing is a strategic decision that impacts your finances and operations. This guide has detailed the implications of each option to help you make an informed choice.

Leasing is ideal if you prioritize predictable monthly expenses, access to the latest technology without a large upfront cost, and inclusive maintenance. It’s a smart choice for growing companies that need to preserve capital.

Buying makes sense if you have strong cash flow, plan to use the equipment long-term, and prefer full ownership. The long-term cost savings and tax benefits of Section 179 can be significant.

The right choice depends on your unique business needs. A fast-growing company may benefit from the flexibility of leasing, while a stable practice might prefer the long-term value of purchasing.

The key is having a reliable provider. At Kraft Business Systems, we partner with businesses throughout Michigan to understand their workflow, growth plans, and budget. We provide guidance and support to ensure your technology serves you well for years to come.

Ready to move forward with confidence? Find the right technology solution for your business and let’s discuss what makes the most sense for your needs.