For many businesses, navigating office equipment can feel complex. One common solution that helps manage costs and keep technology current is leasing. When you hear about all leasing copiers, it refers to the various financing programs businesses use to acquire these essential machines without buying them outright.

Most businesses choose to lease their copiers for several clear reasons:

- Preserved Cash Flow: You avoid a large upfront purchase cost. This means more money stays in your business for other vital operations.

- Access to Modern Technology: Leasing makes it easier to get the latest, most efficient copiers. You can upgrade regularly without the burden of selling old equipment.

- Predictable Monthly Expenses: Lease payments are consistent, making budgeting simpler and more transparent.

- Tax Advantages: Lease payments are often treated as a pre-tax business expense, which can offer significant tax benefits.

- Included Service and Supplies: Many leases bundle maintenance, repairs, and even toner, ensuring your copier runs smoothly with no surprise costs.

It’s a popular choice for a reason: About 8 out of 10 copiers today are acquired through some form of financing, with leasing being the most common. It’s a flexible way to equip your office efficiently.

Leasing vs. Purchasing: Which Path is Right for Your Business?

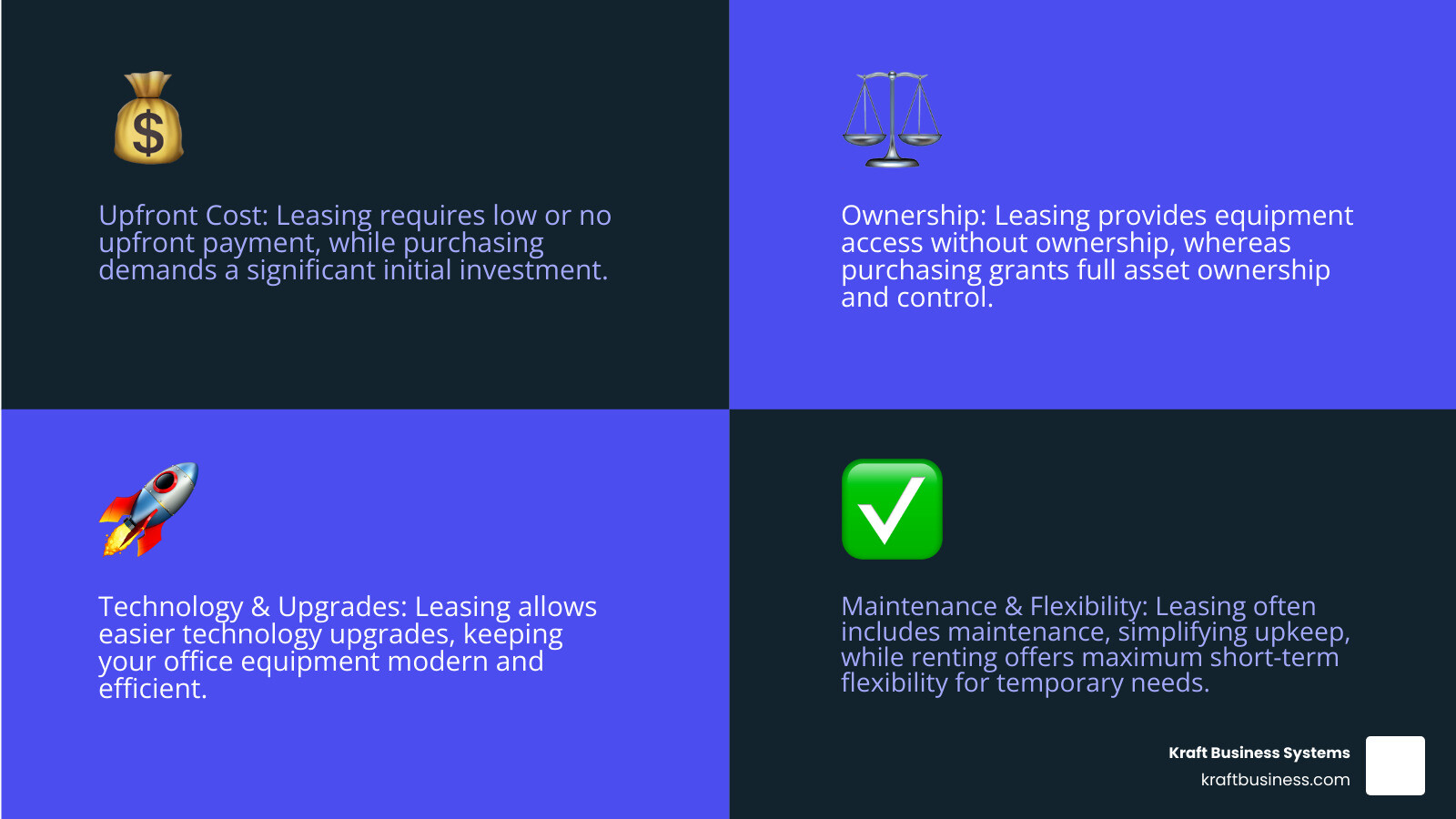

Choosing how to acquire an office copier is a significant decision that impacts your cash flow, assets, and tax strategy. The right choice depends on your business’s unique needs and long-term goals.

The Case for Leasing a Copier

Leasing is a popular choice for its financial flexibility and access to current technology. Key advantages include a lower upfront cost, often requiring little to no down payment, which preserves cash for other operations—a major benefit for small businesses looking to lease printers. Leases come with predictable monthly payments, simplifying budgeting. Leasing also provides access to modern technology, allowing businesses to upgrade to the latest multifunction printers (MFPs) every few years without being stuck with outdated equipment. Furthermore, many all leasing copiers agreements feature bundled maintenance and service, covering repairs, parts, and supplies like toner for consistent uptime. Finally, leasing offers tax advantages, as payments are typically a pre-tax business expense, allowing for full deductions and potential tax benefits.

The Case for Purchasing a Copier

Purchasing a copier makes sense for businesses with stable, long-term needs and available capital. The primary benefit is full ownership; the copier becomes a business asset you control completely. After the initial purchase, there are no ongoing payments, which can lead to a lower total cost over the machine’s lifespan. Ownership also allows for asset depreciation, a different tax advantage where you deduct the machine’s value over time. Consult an accountant to see how this can be claimed on your taxes. Lastly, purchasing means no end-of-lease hassle, avoiding return shipping fees or buyout negotiations. While a purchased copier may be used for over six years, leased units are often upgraded every three to four years, highlighting the trade-off between long-term cost and access to current technology.

What About Renting?

Beyond leasing and purchasing, renting is a third option, ideal for short-term needs like events, temporary project sites, or seasonal rushes in document production. While rentals offer maximum flexibility with no long-term commitment, they typically have a higher monthly cost than a lease. For temporary needs, copier rentals are an excellent solution.

| Feature | Leasing | Purchasing | Renting |

|---|---|---|---|

| Upfront Cost | Low to None | High | Low to Moderate |

| Monthly Cost | Predictable, generally lower than buying | None after initial purchase (plus maintenance) | Higher than leasing, but short-term |

| Ownership | Lessor owns, lessee uses | Lessee owns | Lessor owns, lessee uses for short term |

| Maintenance | Often bundled | Separate cost | Often included |

| Best For | Access to new tech, budget predictability, frequent upgrades | Long-term use, asset ownership, stable needs | Short-term projects, events, temporary needs |

The decision to lease, buy, or rent truly depends on your unique business situation. At Kraft Business Systems, we love helping our clients weigh these factors to figure out the very best approach for their office equipment needs. For even more insights, check out our guide on leasing over buying printers for office.

Decoding the Lease: Understanding Copier Contracts and Terms

Once you decide leasing is right for your business, the next step is understanding the lease agreement. Familiarizing yourself with the contract details, from the terms to end-of-lease options, is key to a smooth experience. For more details, review our guide on printer lease agreements.

Common Lease Types: FMV vs. $1 Buyout

When you’re looking into all leasing copiers, you’ll encounter two main lease types.

The Fair Market Value (FMV) Lease, or Operating Lease, is the most common type. It typically offers lower monthly payments because you are paying to use the equipment, not to own it. At the end of the term, you can return the copier, renew the lease, or purchase it at its current fair market value. This option is ideal for businesses that want to upgrade technology frequently and prefer predictable costs.

The $1 Buyout Lease, or Capital Lease, is structured for ownership. At the end of the term, you can buy the copier for one dollar. Monthly payments are higher than an FMV lease, but you gain full ownership of the asset. This is a good choice if you plan to keep the copier long-term and want to finance the purchase. Learn more in our guide to lease to own printers.

Standard copier leases run for 36 to 60 months, with a 36-month FMV lease being a popular choice. Understanding your end-of-term options is crucial to avoid surprises. Your choices typically include:

- Renew: Continue the lease, often at a reduced rate, if the copier still meets your needs.

- Buyout: Purchase the equipment. With a $1 buyout lease, the cost is nominal. With an FMV lease, the price is based on the copier’s current market value.

- Return: Send the copier back to the leasing company. Be aware that you are often responsible for return shipping costs, which can range from $400 to $800 or more.

- Upgrade: Start a new lease with a newer model. Over 90% of businesses choose to upgrade, ensuring they always have modern technology.

Knowing these options and their associated costs upfront is vital. For more details, see this guide on what happens at lease expiry.

How to Avoid Common Pitfalls

Lease agreements can contain pitfalls, but awareness helps you avoid them.

- Automatic Renewals: Many leases automatically renew for up to 12 months if you don’t provide written notice of your intent to terminate. Mark your calendar to contact your provider 3-6 months before the lease ends.

- Escalation Fees: Annual service cost increases of 7-10% are standard to cover aging equipment. Anything over 15% is considered high and should be questioned.

- Non-Cancellable Clauses: Copier leases are almost always non-cancellable. You are committed to making all payments for the full term, even if you stop using the machine.

- Insurance Requirements: You are required to insure the leased copier. If you don’t provide proof of insurance, the leasing company will add a surcharge to your bill, often 6-8% of the monthly payment.

Understanding these key aspects of your copier lease is truly essential for a smooth and cost-effective experience. Knowledge is power, especially when it comes to your business’s bottom line!

The True Cost of All Leasing Copiers: What Factors Influence Your Payment?

The true cost of all leasing copiers is more than just the monthly payment. It’s a combination of several factors that you must understand for accurate budgeting and to avoid surprises. Let’s break down what shapes your total leasing cost.

Key Factors That Determine Your Rate

Your monthly lease rate is calculated based on several key factors:

- Copier Features: A basic black-and-white copier is more affordable than a color multifunction device with advanced features.

- Color vs. B&W: Color capability increases the lease rate and the cost per page.

- Finishing Options: Features like stapling, hole-punching, booklet-making, and extra paper trays add to the cost.

- Copier Speed (PPM): Faster machines designed for higher volumes have higher lease rates. Match the speed to your actual office needs.

- Print Volume Allowance: Your lease includes a set number of monthly prints. A higher allowance results in a higher base payment.

- Lease Term Length: Longer terms (e.g., 60 months) typically have lower monthly payments than shorter terms (e.g., 36 months), but involve a longer commitment.

Understanding these factors helps you manage your office printer lease rates and overall investment.

The Role of the Service & Supplies Contract

Beyond the equipment, the service and supplies contract is a crucial part of your total cost.

This contract typically covers:

- Toner and other consumables (excluding paper and staples).

- All parts and labor for repairs.

- Preventative maintenance and regular servicing.

This is usually structured on a cost-per-copy model, where you pay a fixed rate for each page printed, making costs predictable. The service agreement can be bundled with the lease for a single payment or kept separate for more flexibility. A service contract is essential for maintaining any office copier, and our copier leasing and printer repair services are designed to keep your equipment running perfectly.

Understanding Overage Charges and Duty Cycles for All Leasing Copiers

Two often-overlooked terms that impact cost are overage charges and duty cycle.

- Overage Charges: These are fees for printing more than your monthly allowance. To manage this, consider a base volume that covers about 80% of your average usage, providing a buffer without overpaying for unused pages.

- Duty Cycle: This is the maximum number of pages a machine can theoretically produce in a month. However, the recommended monthly workload is the more important figure, often just 10% of the duty cycle. Exceeding the recommended workload regularly can lead to increased wear and service calls.

Understanding these details is key to managing your printer leasing costs and selecting the right machine.

Key Questions to Ask Before You Sign a Copier Lease

Before signing any of all leasing copiers agreements, it’s crucial to ask the right questions. This due diligence ensures you get what your business needs without surprises. A reputable dealer will welcome your questions as you select the right printer lease for your business.

Questions About the Equipment and Service

Focus on the equipment and the service that supports it.

- What is the total monthly cost? This must include both the equipment lease and the service/supplies contract.

- What is the overage rate for B&W and color prints?

- What is the guaranteed service response time? Quick repairs minimize business downtime.

- What is included in the service contract? Confirm coverage for toner, parts, labor, and preventative maintenance.

- Is staff training included?

- Is there a usage reporting system to track print volumes?

- What is the policy for a machine that breaks down frequently?

- Are there additional fees for installation, network setup, or removal of old equipment?

A managed print services assessment can provide deeper insights into your needs.

Questions About the All Leasing Copiers Agreement

Scrutinize the lease agreement itself to avoid future issues.

- What type of lease is it (FMV or $1 Buyout)?

- What are the end-of-lease options and their specific costs?

- Are there automatic renewal clauses? Clarify the notice period required to prevent this.

- What are the annual escalation fees? Know the percentage and if it’s negotiable.

- Who is responsible for return shipping costs?

- What are the early termination fees and how are they calculated?

- Are there any hidden fees, such as initiation or insurance surcharges?

- Can the contract be customized if business needs change?

- Who is the leasing company (the financial backer) versus the service provider?

Asking these questions helps you get a transparent commercial copier lease quote and prevent unexpected costs.

Conclusion: Making the Smart Choice for Your Office

Navigating all leasing copiers is a strategic move when you’re well-informed. By understanding the benefits of leasing versus buying, the details of lease agreements, and the factors that influence cost, you can make a smart decision. Asking the right questions is your best tool to secure a transparent deal that benefits your business operations and avoids unexpected costs.

At Kraft Business Systems, located in Grand Rapids, MI, and serving businesses across Michigan including Acme, Ann Arbor, Bellaire, Detroit, Lansing, Traverse City, and Wyoming, we understand that every business has unique needs. We specialize in providing innovative and secure technology solutions, leveraging our diverse team of consultants and industry experts. Our goal is to help you select the perfect copier and lease agreement that aligns with your operational requirements and financial goals.

Don’t let the fine print intimidate you. We are here to guide you through the process, offering transparent and custom solutions for your office equipment needs. By making an informed decision, you’re not just getting a copier; you’re making a strategic business choice that supports your growth and efficiency.

Ready to explain your copier leasing options? Contact us today to discuss how we can help your business thrive with the right technology.

How much does it cost to lease a copier?

The cost to lease a copier depends on its features, speed, and print volume.

Low-Volume B&W: $50 - $150 per month.

Moderate-Volume Color: $150 - $350 per month.

High-Volume/Production: $600+ per month.

When factoring in the equipment lease plus the maintenance and supplies contract, a typical office often spends between $150 and $350 per month in total. This comprehensive cost covers the machine and service, ensuring it runs smoothly without surprise expenses.

What is the most common copier lease term?

Copier lease terms typically run from 36 to 60 months. The most popular choice is a 36-month Fair Market Value (FMV) lease, which offers a good balance between commitment and the ability to upgrade technology regularly. Shorter terms have higher monthly payments, while longer terms have lower payments but require a longer commitment to the equipment.

Can I get out of a copier lease early?

Copier leases are almost always non-cancellable contracts. This means you are obligated to make all payments for the entire lease term, even if you stop using the copier. Ending a lease early typically requires paying the remaining balance or a substantial penalty. Therefore, it is crucial to choose a lease term that aligns with your business's long-term plans, as exiting early has significant financial consequences.