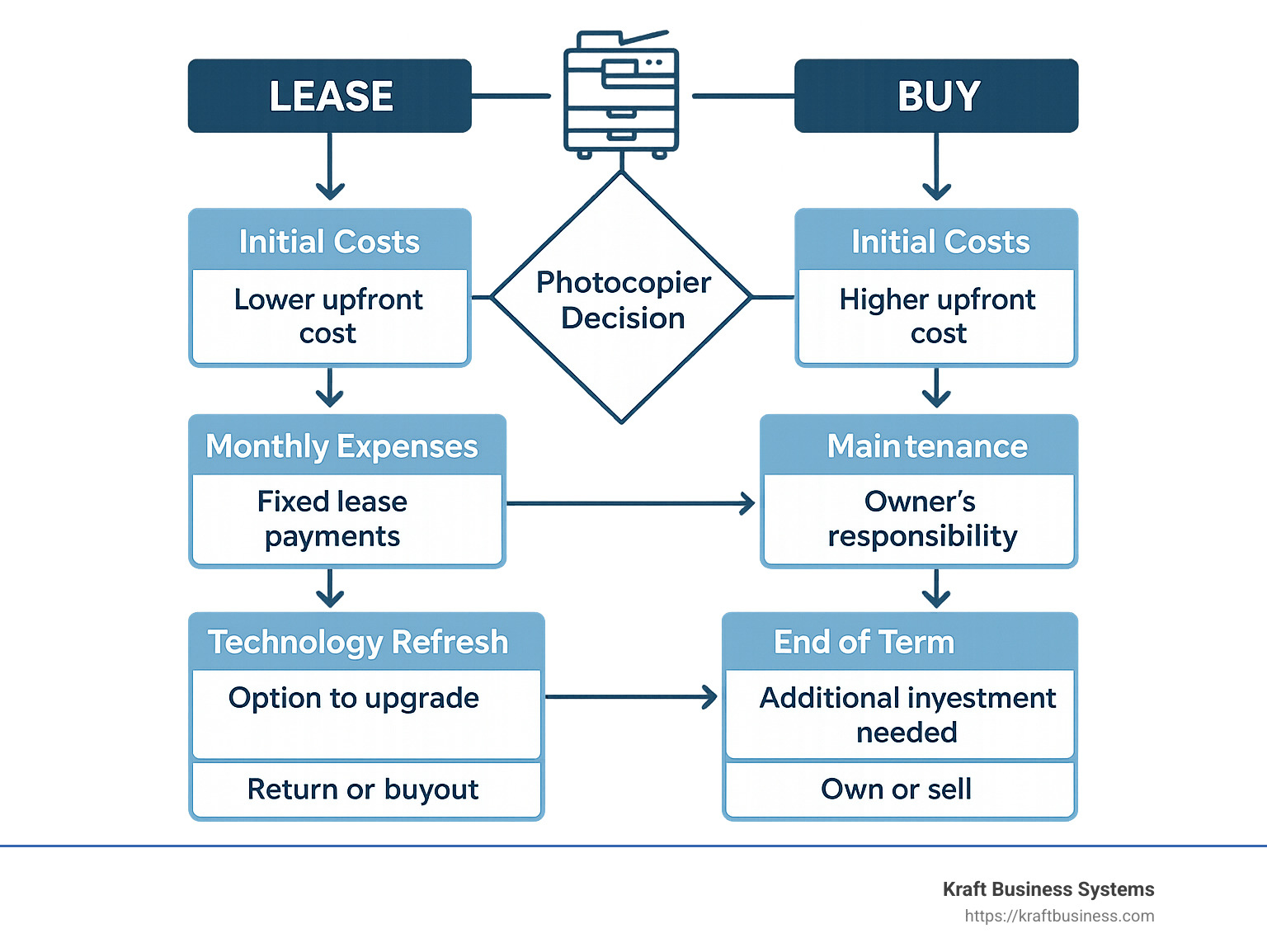

When that aging office copier finally gives up, you’re faced with a crucial decision. Should you buy a new machine outright or consider an office photocopier lease? For many businesses, leasing offers the perfect balance of budget-friendly access to essential technology without the hefty upfront investment.

Think of leasing as renting equipment with structure. You’ll sign a contract (typically running 36-60 months) that allows your business to use a photocopier while making predictable monthly payments. The beauty lies in the flexibility—you’re not stuck with outdated technology as your business grows and evolves.

“It’s just a copy machine, and my office depends on it. I need the best,” an office manager recently told us. But finding “the best” means understanding how photocopier leasing actually works and which option aligns with your specific needs.

When you choose an office photocopier lease, you’re essentially trading a large one-time purchase for manageable monthly payments. This preserves your capital for core business operations—something particularly valuable for growing mid-sized companies. Plus, many lease agreements include maintenance coverage, eliminating those surprise repair bills that wreak havoc on tight budgets.

You’ll generally encounter two main lease types: Fair Market Value (FMV) leases, which typically offer lower monthly payments with options to buy, return, or upgrade at lease-end; and $1 buyout leases, which build ownership into the payment structure, allowing you to purchase the equipment for just $1 when the lease concludes.

Monthly costs vary widely based on the equipment type, features, and your expected printing volume. A basic desktop multifunction printer might run around $70 monthly, while high-volume production machines can exceed $650 per month.

Before signing on the dotted line, you’ll want to thoroughly understand the agreement structure, potential hidden fees, and where you have room to negotiate. A well-structured lease can save your business thousands over time, while a poorly negotiated one might leave you stuck with outdated technology and unexpected costs.

Office Photocopier Lease 101: How It Works

Thinking about getting an office photocopier lease for your business? It’s a lot like leasing a car—you get to use a nice machine without paying the full price upfront, and when the lease ends, you have several options for what happens next.

Let’s break down how these leases actually work in the real world.

When you lease a photocopier, you’re essentially entering into a structured rental agreement. Your business forms a relationship with a leasing company that provides the equipment while you make regular monthly payments for the privilege of using it.

Most businesses encounter two main types of leases:

Operating Lease – This is what most companies choose for office equipment. The leasing company keeps ownership of the copier throughout the lease period. Your monthly payments stay lower because you’re only paying to use the equipment, not to eventually own it.

Capital Lease – Think of this more as a financing plan toward ownership. Your monthly payments will be higher, but you’re building equity in the equipment with each payment.

Getting approved for an office photocopier lease isn’t complicated, but leasing companies will typically check:

- Your business credit score

- How long you’ve been in business (established businesses with 3-5 years of history get the best terms)

- Whether you’ll provide a personal guarantee (especially important for newer businesses)

- Your expected monthly print volume (to match you with the right machine)

Most leases require zero down payment, which is great for keeping your cash flow healthy. Many also include technology refresh options that let you upgrade to newer models before your lease ends—though this usually means extending your term or adjusting your payment structure.

What Is an Office Photocopier Lease?

At its heart, an office photocopier lease is simply a contract between two parties: the lessor (the company that owns the copier) and the lessee (that’s you, the business using it). This agreement gives you the right to use their photocopier for a specific time period while you make regular monthly payments.

Unlike month-to-month rentals, leases commit you to fixed terms typically ranging from 12 to 64 months. Most businesses opt for 36-month leases, though 48 and 60-month terms are also popular if you want to lower your monthly payment.

When shopping for leases, you’ll encounter two main structures:

Fair Market Value (FMV) Lease offers lower monthly payments and maximum flexibility. You don’t own the equipment, and at the end of the lease, you can return it, renew your lease, or purchase it at whatever the fair market value is at that time. This is perfect if you like upgrading to new technology regularly.

$1 Buyout Lease comes with higher monthly payments but works more like financing. As one client told us, “You possess your machine for a dollar when your lease is over.” This option makes sense when you know you want to keep the equipment long-term but don’t want to pay everything upfront.

Most office photocopier lease agreements include usage allowances—a specified number of pages you can print each month before additional charges kick in. Be realistic about your print volume when signing up to avoid surprise overage fees.

End-of-Term Options for Your Office Photocopier Lease

As your office photocopier lease approaches its end date, you’ll need to make some decisions. Understanding your options now can help you plan strategically:

Return the Equipment – The simplest option, especially with an FMV lease. You’ll need to schedule pickup and ensure the equipment is in reasonable condition. You’ll typically pay for shipping it back to the leasing company.

Renew Your Lease – If you’re happy with your current machine, you can often extend your lease month-to-month or sign up for another fixed term. Watch out for the “evergreen clause” though—without proper notification (usually 90-120 days before your lease ends), many leases automatically renew for periods ranging from 30 days to a full year.

Buy the Equipment – With an FMV lease, you can purchase the equipment at its current market value. With a $1 buyout lease, you’ll pay just $1 to take ownership. This makes sense if the equipment still meets your needs and works well.

Upgrade to New Technology – Many businesses use lease-end as the perfect time to upgrade. Your current leasing company might offer special incentives to lease new equipment from them.

To properly exercise any of these options, you’ll need to send a Letter of Intent (LOI) to the leasing company. This formal document should:

- Be printed on your company letterhead

- Clearly state what you want to do (return, renew, or purchase)

- Include your lease number and equipment details

- Be signed by someone authorized to make this decision

- Be sent 90-120 days before your lease expires

As we often remind our clients at Kraft Business Systems: “Send a Letter of Intent 90–120 days before lease expiration to return equipment; otherwise the lease auto-renews for 90 days up to a year.” This simple proactive step can save you from unexpected automatic renewals and unnecessary costs.

How Much Does It Cost? Breaking Down the Numbers

The cost of an office photocopier lease isn’t a one-size-fits-all figure, but understanding what influences your monthly payment can help you budget wisely and negotiate better terms.

Think of leasing costs like building blocks – each feature and specification adds to your total. The main factors that determine your monthly investment include the equipment type, print volume, color capabilities, special features, lease term length, and whether you include service and maintenance.

To give you a clearer picture, a basic desktop multifunction printer might start around $70 monthly, while mid-range office workhorses typically run between $195-$350 per month. If your business needs a high-volume production machine, expect to invest $650 or more each month.

These figures typically don’t include service contracts, which usually start around $30 monthly. These agreements cover the parts and labor that keep your equipment running smoothly, though they rarely include consumables like paper and staples.

For a deeper dive into what affects your photocopier costs, check out our guide on Office Photocopier Rental: Top 5 Cost Factors to Consider.

Cost Factors You Control

While some aspects of your office photocopier lease are fixed based on equipment value, you have more control than you might think over your monthly costs.

Print volume commitments directly impact what you’ll pay. Before signing on the dotted line, take time to audit your actual usage over several months. Consider seasonal fluctuations and growth projections to avoid paying for capacity you don’t need or facing overage charges for underestimating.

“We often see clients who’ve committed to 10,000 pages monthly when they only need 6,000,” says one of our specialists. “That’s like paying for a premium cable package when you only watch the basic channels.”

Lease term length offers another opportunity for control. Longer terms typically mean lower monthly payments but commit you to the technology for an extended period. If your business is growing rapidly or technology changes quickly in your industry, a shorter term might make more sense despite the higher monthly cost.

Feature selection can significantly impact your bottom line. That fancy booklet-maker might look impressive during the demo, but if you only make booklets twice a year, it’s probably not worth the extra monthly cost. Time is money – features that automate manual tasks often pay for themselves through increased productivity.

Separate service agreements provide flexibility that bundled packages don’t. By keeping your service contract separate from your lease, you can adjust service levels as your needs change and avoid the automatic 10% annual increases common in bundled agreements.

Your credit rating also plays a role in determining lease terms. If your business is new, consider negotiating annual credit reviews that could remove personal guarantees after establishing payment history. Some leasing companies offer better terms after you’ve demonstrated reliable payments for a year.

Typical Monthly Price Ranges

Let’s break down what you can expect to pay for different types of machines on an office photocopier lease.

Desktop Multifunction Printers (MFPs) are your entry-level option, typically leasing for around $70 monthly. They’re perfect for small teams or low-volume environments, offering basic printing, copying, and scanning. Just don’t expect blazing speeds or huge paper capacity from these compact assistants.

The real workhorses of most offices are Mid-Range Office Copiers, which generally lease for $195-$350 monthly. These reliable machines handle moderate volume with print speeds of 30-55 pages per minute. They come with multiple paper trays, basic finishing options like stapling, and convenient features like network connectivity and mobile printing. For most small to medium businesses, these models hit the sweet spot of performance and affordability.

For organizations with serious print demands, Production/High-Volume Copiers start around $650 monthly and can exceed $900 for premium setups. These powerhouses offer print speeds of 60+ pages per minute, advanced finishing options like booklet-making and hole-punching, and enterprise-level security features. They’re built for continuous operation in high-demand environments.

Be mindful of those escalation clauses hiding in the fine print! Many service agreements include automatic annual increases of approximately 10% unless you specifically negotiate otherwise. Over a 60-month lease, these increases can add thousands to your total cost.

“Maintenance agreements increase 10% every year, but you can negotiate to have no annual increases,” advises our lead consultant. This simple negotiation point is often overlooked but can save substantial money over the life of your lease.

At Kraft Business Systems, we help our Grand Rapids clients understand these costs upfront, so there are no surprises down the road. We believe transparency builds better business relationships.

Lease Agreement Types & Terms You Must Know

Shopping for an office photocopier lease can feel like learning a new language. With terms like “FMV,” “buyout options,” and “evergreen clauses” being thrown around, it’s easy to get confused. Let’s break down what you really need to know in plain English.

Think of your lease agreement as the rulebook for your relationship with the copier company. Getting familiar with these terms now can save you thousands of dollars and countless headaches later.

The most common lease types you’ll encounter are Fair Market Value (FMV) leases and $1 Buyout leases. Each serves a different purpose depending on your business goals.

With an FMV lease, you’re essentially renting the equipment with flexibility at the end. Your monthly payments stay lower because you’re only paying for the equipment’s depreciation during your use. When the lease ends, you can walk away, renew, or buy it at whatever the market says it’s worth at that time.

A $1 Buyout lease works more like financing a purchase. Your monthly payments run higher, but at the end of the term, you own the equipment outright for just one dollar. This makes sense when you know you want to keep the copier long-term.

Some companies also offer Lease-to-Own options, which are similar to $1 buyouts but might have more flexible terms. These are often marketed to newer businesses or those with limited credit history.

The term flexibility of your lease matters too. While 36 months is the industry standard, terms can range anywhere from 12 to 64 months. Shorter terms mean higher monthly payments but faster technology refreshes, while longer terms reduce your monthly costs but might leave you stuck with outdated equipment.

Most leases include performance guarantees – basically a promise that if your machine doesn’t work as advertised, they’ll replace it. This protection is especially valuable for businesses that depend heavily on their copiers.

Pay close attention to page allowances in your contract. These specify how many pages you can print monthly before incurring extra charges. Choosing the right allowance requires honestly assessing your actual print volume – not what you hope it might be.

FMV vs $1 Buyout Leases

When deciding between lease types for your office photocopier lease, the choice often comes down to flexibility versus ownership.

FMV leases typically cost about 10-15% less per month than their $1 buyout counterparts. This difference exists because you’re only paying for the equipment’s depreciation during your use, not its entire value. For example, a machine that costs $350 monthly on a buyout plan might only run you $300 with an FMV structure.

One of the biggest advantages of an FMV lease is the freedom it gives you when the term ends. Technology changes rapidly, and that cutting-edge copier you leased might be middle-of-the-road by the end of your term. With an FMV lease, you can simply hand it back and upgrade to something newer.

Think of it like leasing a car – you get to drive something nice for a few years, then swap it out for the latest model without worrying about selling your old vehicle.

On the flip side, a $1 buyout lease is essentially a purchase plan with the payments spread out. You’re committing to ownership from day one, just paying for it over time. This makes sense for equipment that has a long useful life or when you’re confident your needs won’t change dramatically.

The tax treatment of these leases differs too. FMV leases generally count as “true leases” for tax purposes, with payments potentially fully deductible as operating expenses. $1 buyout leases are typically treated as capital leases, similar to a purchase with financing. Section 179 of the IRS tax code may allow deduction of the full equipment cost in the year it’s placed in service, which can benefit $1 buyout arrangements.

As one of our clients recently put it: “Buying a printer is almost always less expensive long-term, and a purchased printer can be sold whereas a leased printer cannot.” A $1 buyout lease offers that middle ground – eventual ownership without the large initial cash outlay.

Your choice ultimately depends on your priorities. Choose FMV if you value lower monthly payments, flexibility, and regular technology updates. Go with a $1 buyout if long-term ownership matters more than having the latest features.

Service & Maintenance Contracts

The service and maintenance agreement might seem like a boring afterthought when signing your office photocopier lease, but it can actually make or break your experience with your new equipment.

Think about it: your shiny new copier is only valuable when it’s actually working. The service contract ensures it stays that way throughout your lease term.

Most standard service agreements cover parts and labor for repairs, regular preventative maintenance, technical support, and response time guarantees. Some also include toner and other consumables (though paper and staples are almost always your responsibility).

You’ll typically have two options for structuring your service agreement: bundled with your lease or as a separate contract. While bundling might seem convenient (one payment, one vendor to deal with), keeping these agreements separate almost always works in your favor.

Here’s why separation makes sense: Your printing needs might change dramatically over a 5-year lease term. If your service contract is built into your lease, you’re locked into those terms – including automatic 10% annual increases – with no flexibility to adjust as your needs change.

Service contracts typically follow one of two pricing models. With the cost-per-page model, you pay a fixed rate for each page printed (commonly around $0.01 for black and white, $0.08 for color). The fixed monthly fee model charges a set payment regardless of volume, though there are usually maximum page thresholds.

Basic service agreements start around $30 monthly but can cost significantly more depending on your equipment and print volume. Be aware that many providers build in automatic annual increases of approximately 10% – a practice that can dramatically increase your costs over time.

When reviewing your service contract, pay special attention to these negotiation points:

Annual increase caps are worth fighting for – try to eliminate increases entirely or cap them at 2-3% instead of the standard 10%.

Response time guarantees should align with your business needs. If your operation depends heavily on your copier, next-business-day service might not be good enough.

Quarterly reviews allow you to adjust page allotments based on actual usage, preventing you from overpaying for unused capacity.

Toner inclusion policies vary widely – confirm whether toner is included or billed separately to avoid surprises.

Performance guarantees ensure that equipment will be replaced if it consistently fails to meet manufacturer specifications.

At Kraft Business Systems, we’ve seen too many businesses get stuck with service agreements that don’t serve their needs. That’s why we recommend negotiating comprehensive coverage that grows with your business, including quarterly reviews to ensure you’re never paying for more than you need while maintaining optimal equipment performance across all our Michigan locations.

Hidden Fees, Negotiation Tips, and Red Flags

When entering an office photocopier lease, the headline monthly payment is just part of the story. Behind that attractive number often lurk additional costs that can significantly impact your bottom line. Being aware of these potential surprises can save your business thousands over a typical lease term.

Common Hidden Fees to Identify

Beyond the base lease payment, be alert for several sneaky charges that dealers rarely mention upfront. Delivery and installation fees can add hundreds to your initial costs, even though these are one-time services that could easily be included in your agreement. Document processing fees—typically ranging from $50-$150—serve little purpose beyond padding the dealer’s profit margin.

Many businesses are surprised by travel charges that appear on service call invoices. Even when toner is “included” in your service contract, the shipping costs might not be, creating unexpected expenses with each delivery. And don’t forget about those end-of-lease freight charges when it’s time to return your equipment—these can be substantial, especially for larger machines.

One industry insider puts it plainly: “10% annual increases, travel fees per service call, and shipping fees for toner should be negotiated as included.” These seemingly small items can add thousands to your total cost over a multi-year lease.

Negotiation Checklist

Before signing an office photocopier lease, use this negotiation checklist to secure the most favorable terms. Almost everything in a lease agreement is negotiable, especially if you’re working with a local provider like Kraft Business Systems that values long-term relationships over one-time sales.

Keep your service agreement separate from your lease. This simple step provides tremendous flexibility to adjust service levels as your needs change, avoid being locked into escalating costs, and even change service providers if necessary without affecting your equipment lease.

Cap or eliminate annual increases on your service costs. Standard contracts often include automatic 10% annual increases that can dramatically inflate your expenses over time. Request “no annual increases” in writing, or if the provider resists, negotiate a cap of 2-3% to match inflation. Get these terms explicitly stated in your contract.

Replace automatic renewals with a 30-day notice period. The dreaded “evergreen clause” can lock you into additional months or even a full year without your explicit consent. Ensure the contract specifies that it converts to month-to-month after the initial term, and cross out any language about automatic renewals for fixed periods.

Ensure installation, training, and network setup are included at no additional cost. These essential services should be part of your agreement, not surprise line items on your first invoice.

Secure a written performance guarantee that protects you throughout the lease term. If your equipment fails to operate according to manufacturer specifications, it should be replaced at no additional cost.

Schedule quarterly business reviews to adjust page allowances based on actual usage, address service issues proactively, and ensure you’re not overpaying for unused capacity.

As one industry expert advises: “No annual increases; 30-Day renewal at the end of the lease (cross out the Evergreen Clause); separate maintenance agreement; add a performance guarantee; include install, setup, delivery, and training; no document processing fees.” These negotiation points can save thousands over the life of your lease.

Avoiding Hidden Costs

Beyond negotiating favorable terms, proactively identifying and avoiding hidden costs is essential for managing your office photocopier lease effectively. Smart planning can prevent many unexpected expenses before they appear.

Know your actual print volume before signing anything. Many businesses overestimate their print needs, leading to unnecessarily expensive equipment and unused page allowances. Track actual usage across all departments for 2-3 months, accounting for seasonal fluctuations in your business. Consider digital change initiatives that might reduce future print needs, and build in modest growth projections without overestimating.

Request all-inclusive pricing that clearly outlines every cost component. Your quote should detail the base lease payment, service costs (including all parts and labor), consumables coverage, and any potential additional fees. When comparing proposals, one provider might seem less expensive until you factor in all costs. As industry experts note: “Compare prices, know needed features, and match copier speed to your expected usage to avoid overpaying.”

Understand your upgrade options before signing. Technology needs change rapidly, so ensure your lease includes clear options to upgrade equipment mid-lease and transparent terms for how remaining payments are handled during upgrades. Most importantly, confirm that you won’t be financing old equipment in new leases.

Avoid rolling over debt when upgrading equipment. One of the costliest mistakes businesses make is incorporating remaining payments from an old lease into a new one. This means you’re financing equipment you no longer use. Complete your current lease before upgrading when possible, or negotiate a clean break from the old lease if you must upgrade early.

Get shipping and return costs in writing. End-of-lease return costs can be surprisingly high, so negotiate to have return shipping included in your initial agreement. Confirm who’s responsible for packaging the equipment and understand any requirements for condition upon return.

Mark your calendar for renewal decisions. The “evergreen clause” catches many businesses off guard. Calendar the date for sending your non-renewal notice (typically 90-120 days before lease end), send notices via certified mail or other trackable methods, and follow up to confirm receipt of your non-renewal notice.

At Kraft Business Systems, we believe in transparent pricing and helping our clients throughout Michigan avoid these common pitfalls. Our approach focuses on right-sizing equipment to actual needs and providing clear, comprehensive agreements without hidden surprises.

Frequently Asked Questions about Office Photocopier Leasing

Who Is a Good Candidate to Lease Instead of Buy?

Not every business benefits equally from an office photocopier lease. Understanding if leasing aligns with your situation can save you significant resources and headaches down the road.

Businesses that prioritize cash flow typically find leasing particularly attractive. With minimal upfront investment—often requiring zero down payment—you can preserve your working capital for revenue-generating activities while enjoying predictable monthly expenses that make budgeting simpler.

Fast-growing companies also benefit tremendously from the flexibility that leasing provides. As your business expands, you can easily upgrade to larger equipment that meets your evolving needs, avoiding the frustration of being stuck with undersized equipment that can’t keep up with demand.

“Leasing is ideal for businesses with limited upfront capital,” notes one industry expert. This approach allows you to access the equipment you need without tying up funds that could be used for other strategic initiatives.

Organizations that value staying current with technology find leasing particularly advantageous. Rather than owning obsolete equipment a few years down the road, leasing facilitates regular technology refreshes, ensuring you always have access to the latest security features and capabilities.

If your business experiences seasonal fluctuations or has varying print needs throughout the year, certain lease structures can accommodate these changes. Some providers offer flexible terms for seasonal businesses, and service contracts can sometimes be adjusted quarterly to match your actual usage patterns.

Companies with limited IT resources often appreciate the comprehensive maintenance included in lease agreements. This reduces the burden on your technical staff, while service response guarantees minimize downtime. Having access to technical support hotlines provides immediate assistance when issues arise.

At Kraft Business Systems, we help businesses across Michigan evaluate whether leasing or purchasing makes more sense for their specific situation. We consider factors like growth projections, cash flow priorities, and technology requirements to recommend the most advantageous approach.

Can I Terminate My Lease Early?

Early termination of an office photocopier lease is possible but typically comes with financial consequences. Understanding your options before signing can help you steer changes in your business circumstances more effectively.

Most leases include early termination provisions that follow predictable patterns. The most common approach is a buyout formula where you’ll need to pay the remaining lease payments plus the residual value—essentially what the equipment would be worth at normal lease end. Some contracts will discount this amount to present value, providing a small financial break.

“You should finish the term of your lease every time—lease debt doesn’t just disappear,” advises one industry expert. This realistic perspective helps businesses make informed decisions about early termination and plan accordingly.

Some creative alternatives exist if you need to exit a lease. Equipment transfer options allow you to transfer the lease to another qualified business, though this requires finding a willing recipient with acceptable credit. When upgrading equipment, sometimes your new vendor will assume the remaining payments on your existing lease to win your business.

If you must exit a lease early, start by reviewing your contract carefully to understand the specific early termination language and calculations. Don’t hesitate to negotiate with the leasing company—sometimes they’ll offer better terms than what’s contractually required, especially if you’re leasing new equipment from them.

Consider subleasing if your contract allows it. Finding another business to take over payments while you maintain the lease can be a cost-effective solution. For complex situations, consulting a lease specialist might identify options not immediately apparent.

At Kraft Business Systems, we’ve helped many Michigan businesses steer early termination situations. While we always recommend fulfilling lease terms when possible, we understand that business needs change and can help you explore the most cost-effective exit strategies when necessary.

What Tax Benefits Come with Leasing?

The tax implications of an office photocopier lease can significantly impact its overall cost-effectiveness for your business. While individual circumstances vary, understanding the potential benefits helps you make more informed decisions.

With properly structured FMV leases, monthly payments are typically considered operating expenses rather than capital expenditures. This classification means they may be fully deductible in the year they’re paid, which simplifies accounting compared to managing depreciation schedules. This approach creates predictable tax deductions throughout the lease term, making financial planning easier.

The tax treatment of leases can improve your cash flow in several ways. Unlike a purchase that might provide a large upfront deduction that your business can’t fully use, leasing matches tax benefits to your monthly cash outlays. This approach potentially reduces quarterly estimated tax payments, preserving more cash throughout the year.

For businesses subject to Alternative Minimum Tax (AMT), lease payments generally receive the same treatment under both regular and AMT calculations. This consistency can simplify tax planning compared to depreciated purchases that might be treated differently under different tax calculation methods.

While Section 179 allows for immediate expensing of purchased equipment, your business must have sufficient taxable income to benefit from this approach. Leasing spreads the tax benefits over time, which may be advantageous if your income fluctuates or if you’re in a growth phase with limited profitability. It’s worth noting that some lease structures—particularly $1 buyout leases—may still qualify for Section 179 treatment.

“Consult a CPA or tax attorney for specific lease versus purchase tax treatment,” recommends one industry expert. This personalized advice is essential because your specific business structure affects optimal tax strategies, and state and local tax implications vary by location. Recent tax law changes may impact leasing benefits, and your overall tax situation determines the real value of various deductions.

At Kraft Business Systems, we work with businesses throughout Michigan to understand the financial implications of their equipment decisions. While we provide general information about potential tax benefits, we always recommend consulting with your tax professional before making decisions based on tax considerations.

The predictable nature of lease payments often makes budgeting and tax planning simpler, regardless of the specific tax treatment in your situation. This predictability is one of the non-tax benefits that makes leasing attractive to many businesses looking for financial stability and forecasting reliability.

Conclusion

Navigating office photocopier leasing doesn’t have to be as complicated as clearing a paper jam with a deadline looming. By understanding the lease structures, identifying potential hidden costs, and knowing your negotiation leverage points, you can secure an agreement that truly serves your business needs.

The right lease agreement provides more than just equipment—it delivers peace of mind through predictable costs, reliable performance, and the flexibility to adapt as your business evolves. Think of it as future-proofing your business operations while protecting your budget.

Let’s recap what we’ve learned about office photocopier leases. The choice between FMV leases with their lower payments and greater flexibility versus $1 buyout leases with eventual ownership should align with your long-term business strategy. Service agreements are critical components that should ideally remain separate from your lease, with capped annual increases and comprehensive coverage.

Almost everything in a lease agreement is negotiable. From eliminating document processing fees to securing performance guarantees, don’t hesitate to ask for better terms. Your provider should be a partner in your success, not just a vendor collecting monthly payments.

Smart businesses mark their calendars for 120 days before lease end to avoid those sneaky automatic renewals. This advance planning gives you time to evaluate your options without the pressure of an impending deadline. And always watch for those hidden fees—delivery, installation, return shipping, and automatic increases can add thousands to your total cost over the life of a lease.

Whether you’re a growing startup in Grand Rapids or an established enterprise in Detroit, the right photocopier lease supports your operations without draining resources from your core business activities. The goal isn’t just getting a good deal today but establishing a relationship with a provider who understands your evolving needs.

At Kraft Business Systems, we’ve helped businesses across Michigan—from Traverse City to Ann Arbor, Lansing to Sterling Heights—find that sweet spot between cost, capability, and flexibility in their office equipment solutions. Our team understands that every business has unique needs, and we pride ourselves on transparent, straightforward guidance that prioritizes your long-term success.

Making informed decisions about your office photocopier lease ensures your team stays productive while your budget stays on track. It’s about avoiding those paper jams in your business operations and your cash flow.

Don’t get jammed up with the wrong lease agreement. Contact our team at Kraft Business Systems today to explore how we can help your business secure the right equipment with terms that work for your unique situation.