Compliance governance is the framework an organization uses to reliably meet its objectives, manage uncertainty, and act with integrity. It’s the essential structure that helps a business follow all applicable rules while achieving its goals.

Think of it this way:

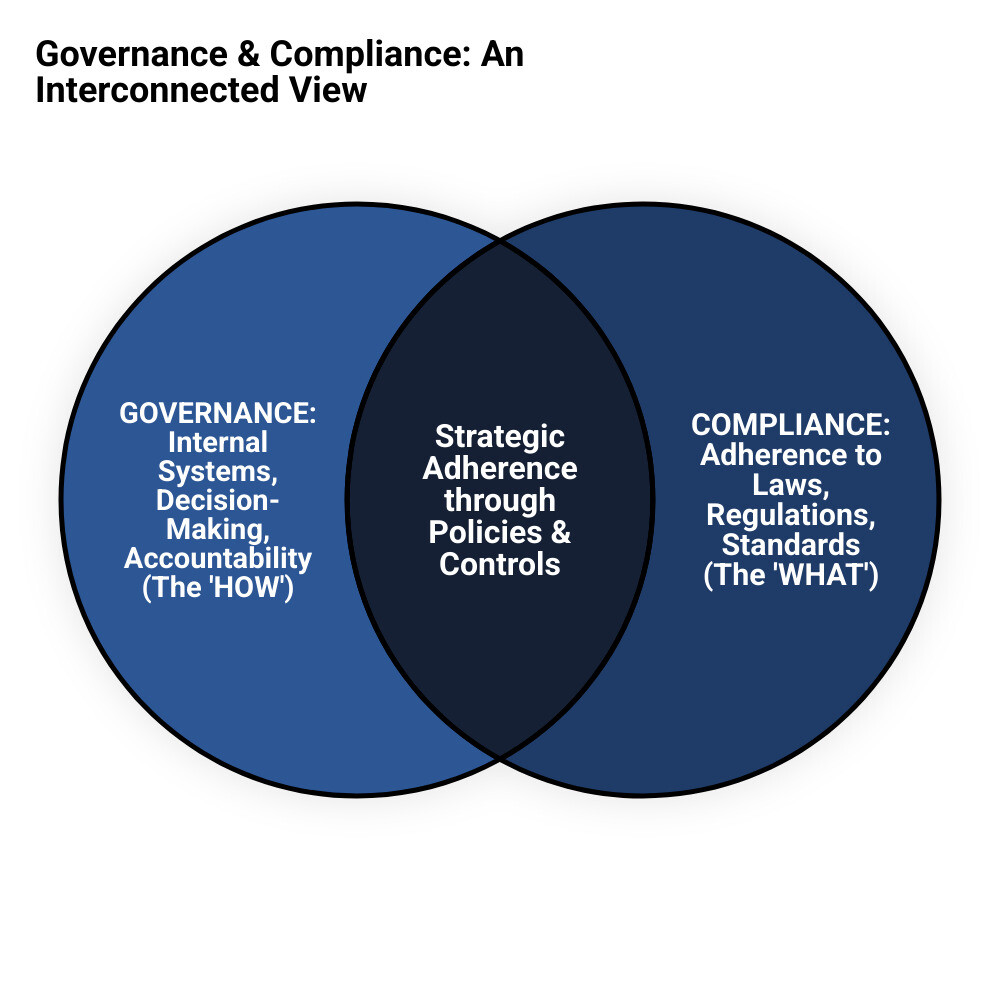

- Governance: This is the “how.” It refers to the internal systems, processes, and principles a company establishes to guide decision-making, resource management, and accountability.

- Compliance: This is the “what.” It means adhering to the specific laws, regulations, and standards that apply to a business, whether they are external rules or internal policies.

In short, governance is the blueprint for managing your company, while compliance ensures everything you do adheres to required regulations. Without strong governance, consistent compliance is nearly impossible.

Many businesses struggle to keep up with complex regulations. Ignoring these rules can lead to significant penalties and reputational damage. That’s why building strong compliance governance is crucial for protecting your business and ensuring smooth operations. This framework is a key part of a larger system called GRC: Governance, Risk Management, and Compliance, which work together to ensure your business runs effectively and builds trust.

Why Compliance Governance Matters for Businesses

Defining the Core Concepts: Governance vs. Compliance

The terms “governance” and “compliance” are often used interchangeably, but they represent distinct concepts. Understanding their unique roles is essential for building a solid compliance governance framework. They are two pieces of a puzzle that create a strong, ethical, and successful business.

Let’s break down their differences:

| Feature | Governance | Compliance |

|---|---|---|

| Where it Comes From | Mostly internal; it’s about the systems and policies your company creates to reach its goals. | Mostly external; these are rules from outside, like laws, industry standards, or contracts. |

| Its Main Purpose | Strategic; aims to improve how your business runs, make decisions better, and ensure everyone is accountable. | Tactical; it’s about meeting specific, set requirements from policies or regulations. |

| Is it a Must-Do? | Generally voluntary; your company sets these for itself. Not following them might not lead to legal trouble. | Often mandatory; set by external groups. Breaking these rules can mean big fines, legal problems, or a damaged reputation. (Though some, like SOC 2, can be voluntary!) |

| What it Focuses On | Making internal processes, policies, and even internal laws better and more organized. | Making sure you conform to external rules, like laws, regulations, and contracts. |

| The Big Picture Goal | To steer and manage the entire organization so it performs well and acts with integrity. | To find out what rules apply, check if you’re following them, see risks of not complying, and fix things if needed. |

Governance provides the internal direction and strategic path, while compliance focuses on following external rules tactically. Strong governance creates the ideal environment for effective compliance. As such, IT Compliance and Governance are two sides of the same coin.

What is Governance in a Business Context?

Governance, the “G” in GRC (Governance, Risk, and Compliance), is how senior leaders guide and control an organization. It’s the operational blueprint that keeps everything on track.

Key elements include:

- Framework: A structured approach of processes, policies, and principles that help achieve company goals.

- Policies: High-level rules that guide team actions and ensure the company meets its legal and ethical duties.

- Processes: Step-by-step guides that turn policies into actionable tasks.

- Principles: The company’s core values and ethical standards that guide behavior and decision-making.

- Decision-making: Clear authorities and methods for making choices that move the company forward.

- Accountability: Clearly defined responsibilities for individuals and departments.

- Internal structure: The company’s hierarchy, reporting lines, and committees that aid control.

- Achieving objectives: The ultimate goal of governance is to reliably hit business targets and act with integrity.

Without solid governance, a business lacks direction and control, struggling to meet its goals.

What is Compliance?

Compliance, the “C” in GRC, means adhering to stated requirements. It involves identifying applicable rules (laws, regulations, contracts, internal policies), assessing adherence, weighing the risks of non-compliance, and taking corrective action.

Compliance involves:

- Adherence: Strictly following established rules, whether internal or external.

- Laws: Abiding by legal mandates, such as the data protection standards set by GDPR.

- Regulations: Conforming to rules from regulatory bodies. For example, healthcare organizations must follow HIPAA, and financial firms must adhere to SOX.

- Industry standards: Meeting benchmarks like PCI-DSS compliance for businesses handling payment card data.

- External rules: Reacting and adapting to requirements from outside the organization.

- Avoiding penalties: A primary driver for compliance is to avoid fines, legal action, security breaches, and reputational damage.

Compliance management is an ongoing process of monitoring and assessment to ensure systems consistently meet required standards. A failure can result in significant financial penalties and operational disruption.

Why Compliance Governance Matters for Businesses

The Pillars of an Effective Compliance Governance Framework

Building a strong compliance governance framework is about setting your business up for long-term success, resilience, and trust, especially in highly regulated industries. A solid framework ensures everyone, from top to bottom, understands and follows the rules. For more on how these pieces fit together, see our article, GRC Governance, Risk and Compliance Explained.

The Role of Leadership and Stakeholders

Effective compliance governance starts with strong leadership and the “tone at the top.” Senior executives and the board of directors must actively demonstrate a commitment to integrity, setting the ethical standard for the entire company.

The Board of Directors provides oversight, ensuring the company meets its goals within legal and ethical bounds. Executive management is responsible for implementing policies and defining responsibilities for risk management and performance evaluation.

Clear accountability is essential. Leaders must know their responsibilities and take an active role in preventing issues like fraud. A claim of ignorance is not a defense for compliance failures. Leadership must consistently enforce policies and hold individuals accountable for violations. This fosters a culture of integrity where employees feel safe to speak up and prioritize ethical behavior.

How Internal Policies and External Regulations Shape Requirements

Both internal rules and external laws are critical in compliance governance, defining the operational boundaries and expectations for your business.

Internal controls are the processes and tools you establish to achieve objectives, protect assets, and ensure operational efficiency. These include daily policies, procedures, and internal checks. Many organizations use The COSO Framework for internal controls as a roadmap for managing risk. Your code of conduct serves as the company’s moral compass, outlining ethical principles and expected behaviors for all employees.

External legal standards are laws set by governments, such as data protection laws like GDPR, which require companies to adapt their compliance programs. Additionally, industry-specific rules, like HIPAA for healthcare or PCI-DSS for payment card handlers, dictate how data is collected, stored, and protected.

A strong compliance governance framework ensures your internal policies and external regulations work together seamlessly, leading to better data quality, increased trust, and legal adherence.

Mandatory vs. Voluntary Aspects of Compliance Governance

Understanding the difference between mandatory and voluntary compliance is key to strategic planning.

Some aspects are legal obligations set by external bodies. Non-compliance can lead to severe consequences, including hefty fines for non-compliance, lawsuits, penalties, and reputational damage. For instance, failing to comply with GDPR has cost companies millions, and the average cost of a data breach continues to rise.

On the other hand, many voluntary standards exist. While your internal governance policies are self-imposed, adopting voluntary compliance frameworks like SOC 2, ISO 27001 (for information security), or ISO 37301 (for compliance management) can provide a significant competitive advantage.

These voluntary efforts demonstrate reliability and trustworthiness to customers, partners, and investors, building customer trust. Going beyond mandatory requirements can be a powerful strategic move.

Why Compliance Governance Matters for Businesses

Integrating Governance, Risk, and Compliance (GRC)

Governance, Risk, and Compliance (GRC) is an integrated strategy for managing an organization’s overall governance, enterprise risk management, and compliance with laws and regulations. OCEG, which pioneered the concept, defines GRC as “the integrated collection of capabilities that enable an organization to reliably achieve objectives, address uncertainty and act with integrity,” also known as Principled Performance®. A critical part of this is GRC Risk Management.

The GRC framework emphasizes a holistic approach to break down silos between these three functions. Managing them independently leads to duplicated tasks, higher costs, and disconnected results.

Key Benefits of a Cohesive GRC Program

Integrating GRC into a cohesive program offers several advantages:

- Improved decision-making: A unified view of risks and compliance status enables more strategic decisions.

- Reduced costs: A holistic approach avoids wasteful overlaps by managing a central library of compliance controls.

- Increased efficiency: Streamlined processes and information sharing boost operational efficiency.

- Improved resilience: An integrated GRC framework helps an organization anticipate and withstand disruptions.

- Shareholder confidence: Effective compliance governance demonstrates sound management, increasing investor trust.

- Avoiding overlaps: Integration prevents the duplication of tasks that occurs when GRC functions are managed independently.

Overcoming Common GRC Implementation Challenges

Implementing a cohesive GRC program has its challenges, including:

- Data management: Managing vast amounts of siloed data.

- Pace of change: Keeping up with evolving regulations and technology.

- Lack of leadership support: GRC initiatives can falter without strong executive sponsorship.

- Incomplete frameworks: Starting with partial GRC efforts can create gaps.

- Fostering a new corporate culture: Shifting from a reactive to a proactive GRC mindset requires significant change.

To overcome these problems, consider these solutions:

- Phased implementation: Start with an audit to identify key areas, then implement changes incrementally.

- Executive buy-in: Secure leadership support from the outset to drive cultural change.

- Focus on people and process: Prioritize defining clear roles and streamlined processes before implementing technology.

- Training and communication: Educate employees on the purpose of GRC and their roles within it.

- Leverage technology wisely: Use GRC software to manage data and monitor compliance in support of your defined processes.

Building and Implementing Your Framework

Now that you understand the what and why of compliance governance, it’s time for implementation. Building your framework is about being proactive, ensuring departmental alignment, maintaining thorough documentation, and enforcing rules consistently. This is a continuous journey, and for areas like Cybersecurity Compliance, a solid framework is non-negotiable.

A Practical Example: Building a Fraud Risk Management System

Let’s walk through a practical example: building a fraud risk management system. This is about preventing issues before they start.

- Risk identification: First, identify where your business is vulnerable to fraud. Pinpoint potential risks in products or platforms, identify internal and external threats, and determine how your system will handle these risks and who is responsible for prevention.

- Defining roles: Clearly define specific roles and responsibilities for everyone involved in fraud prevention. Who oversees operations? What are each team member’s duties? What events trigger specific actions?

- Establishing ethical guidelines: Establish clear ethical guidelines that reflect your company’s core values. Define how to handle conflicts of interest and post-employment situations. Ensure everyone understands the steps the company takes to prevent fraud and the high standards leaders are held to.

- Investigation processes: Create a solid plan for when issues arise. Map out how your company will investigate internal fraud, including clear steps, timelines, and responsible parties.

- Stakeholder accountability: Clearly determine how to hold stakeholders accountable for any breaches of anti-fraud practices. This reinforces that rules apply to everyone.

- Continuous monitoring and documentation: This is an ongoing process. Ensure all initiatives are interconnected and coordinated between departments. Document the entire system clearly and review it regularly with stakeholders to confirm everyone understands their roles. Most importantly, enforce the system consistently to achieve long-term success.

The Role of Technology and Automation

Technology is essential for managing modern compliance governance.

GRC software platforms bring governance, risk, and compliance processes into a single, streamlined hub. They centralize policies, controls, risk assessments, and audit trails. Learn more about Governance, Risk, and Compliance (GRC) Software.

Automation tools are vital for managing complex, distributed IT environments. They can handle routine compliance tasks, such as continuously scanning cloud settings for misconfigurations and fixing them automatically.

This enables real-time monitoring of activities, allowing you to detect and respond to potential threats instantly. You can quickly spot systems that have become non-compliant due to new regulations or accidental changes.

Finally, GRC software provides centralized reporting through interactive dashboards. This gives you a single, clear view of your risk and compliance landscape, making it easier to spot risks, improve processes, and prepare for audits. By embracing technology, you can reduce manual tasks, boost efficiency, and gain actionable insights into your compliance governance health.

The Future of Compliance Governance

The landscape of compliance governance is constantly evolving due to technological leaps, changing regulations, and a connected global business environment. Organizations must be proactive, anticipating emerging threats and opportunities rather than just reacting to them. Frameworks like the global standard for risk management, ISO 31000, offer valuable guidelines for navigating this complexity.

Adapting to Digital Change and AI

Digital change, particularly Artificial Intelligence (AI) and Machine Learning (ML), is reshaping governance and compliance. These tools offer incredible potential but also introduce new challenges.

AI and ML can analyze vast amounts of data to spot patterns, predict potential risks, and suggest proactive mitigation steps. This shifts compliance governance from a reactive to a predictive model, where issues can be anticipated before they occur.

These technologies also automate routine compliance checks, reducing manual effort and improving accuracy. For example, systems can continuously monitor internal controls for security risks, and ML algorithms can detect anomalies that might signal a compliance breach or security threat.

With this digital reliance, cybersecurity has become a central piece of compliance governance. Businesses face growing threats like cloud misconfigurations, inadequate identity and access management (IAM), and malware. While AI helps combat these threats, it also introduces new vulnerabilities that require careful governance.

Furthermore, as data volumes grow, data privacy regulations will become stricter. Your compliance governance framework must be agile enough to adapt, ensuring ethical data handling and adherence to new privacy mandates. The future of compliance will be a dynamic balance of technology, ethics, and a culture ready for constant change.

Frequently Asked Questions about Compliance Governance

It’s natural to have questions when diving into something as crucial as compliance governance. Let’s clear up some common queries.

What is the primary goal of establishing compliance governance?

The primary goal is to build a solid system that helps your organization reliably achieve its targets, manage uncertainties, and act with integrity. It’s about creating a clear roadmap and moral compass for your business, ensuring internal processes align with external laws, ethical standards, and industry best practices. This approach, often called “principled performance,” builds a business that is successful, trustworthy, and resilient.

How does strong governance reduce organizational risk?

Strong governance significantly reduces risk by establishing clear lines of accountability, so everyone knows their responsibilities. It also implements robust internal controls—safeguards that prevent issues. Furthermore, strong governance fosters a culture of transparency, where problems are addressed quickly instead of being ignored. It provides a framework for identifying, assessing, and responding to potential threats before they escalate, minimizing their impact on your business.

Can a small business implement compliance governance?

Absolutely. While the scale may differ, the core principles of compliance governance apply to businesses of all sizes. For a small business, this can mean documenting key processes, defining roles and responsibilities (even if one person wears multiple hats), staying informed about relevant regulations, and fostering an ethical culture. Scalable technology solutions can make this manageable. Companies like Kraft Business Systems offer tools and support custom to the needs of SMBs, helping you manage compliance efficiently and affordably.

Conclusion

In a world of increasing complexity and regulation, solid compliance governance is essential for any business to thrive. We’ve seen that governance is the “how”—the internal frameworks and policies that steer your organization—while compliance is the “what”—adhering to external laws and internal guidelines.

Integrating Governance, Risk, and Compliance (GRC) into a cohesive program offers significant benefits, including better decision-making, reduced costs, and improved organizational resilience. While implementing GRC has its challenges, they can be overcome with a proactive mindset, strong leadership, and cross-departmental teamwork.

Technology like GRC software and AI-powered automation are game-changers, helping you manage compliance efforts efficiently and gain real-time insights. As the digital world evolves, staying ahead of AI advancements and cybersecurity threats is crucial for maintaining a competitive edge.

At Kraft Business Systems in Grand Rapids, Michigan, we understand the unique challenges businesses face. Our team of consultants and experts provides innovative and secure technology solutions custom to your specific needs, serving clients across Michigan. Our goal is to ensure your compliance governance framework is not just a checklist item but a strong foundation for lasting success.

Don’t let the maze of compliance hold you back. Let’s work together to make your organization resilient and future-ready. Strengthen your security posture with Managed Cybersecurity Services and build a business that’s prepared for anything.