Printing equipment leasing companies provide businesses with flexible financing solutions to acquire essential printing technology without large capital expenditures. For busy organizations seeking the right leasing partner, here are five top printing equipment leasing companies to consider:

- ELEASE – Specializing in printing industry since 1995, offers both new and used equipment programs

- CMS Funding – Features application-only leasing up to $150,000 with 24-hour approvals

- Kyocera Financial Services – Provides “Unlimited Plan” with bundled printing, toner, and maintenance

- National Funding – Offers flexible terms and specialized high-value equipment leases

- Alliance Commercial Capital – Provides micro-ticket leasing programs for smaller printing equipment

The decision to lease rather than purchase printing equipment can transform how your business manages its technology investments. As the printing industry continues its evolution, staying competitive means having access to the latest technology without depleting your capital resources.

“Smart business owners distinguish between good debt and bad debt,” notes one industry expert. “Equipment leasing creates good debt that becomes a driver of revenue rather than tying up resources.”

For mid-sized businesses struggling with outdated equipment or unpredictable printing demands, leasing offers a strategic alternative. You gain immediate access to essential technology while preserving cash flow for other critical business initiatives.

The printing industry remains strong despite digital change, with equipment sales increasing to nearly 1,000 units this year. Modern leasing options accommodate everything from basic laser printers to sophisticated digital presses, large-format printers, and specialized binding equipment.

Whether you need flexible payment schedules, 100% financing that includes soft costs like installation and training, or convenient upgrade paths as technology evolves, today’s printing equipment leasing companies offer solutions custom to your unique business requirements.

Essential Guide to Printing Equipment Leasing Companies

Full-Service Printing Equipment Leasing Companies

When you’re looking to upgrade your printing capabilities, printing equipment leasing companies that offer full-service solutions do much more than just handle paperwork. These specialists truly understand print businesses and the equipment that powers them—from sophisticated digital presses to complex binding systems.

Take ELEASE, for example. They’ve been financing printing equipment since 1995, building deep industry knowledge that generic lenders simply can’t match. What makes them particularly valuable is their ability to finance both new and used equipment. Their specialized used equipment program (created in 2001) even helps printing businesses acquire equipment through auctions or from other printers who are upgrading.

These full-service specialists typically finance a comprehensive range of printing technology:

- Digital and offset presses

- Commercial printing equipment

- Binding and finishing systems

- Large-format printers

- Sheet-fed presses

The real advantage of working with printing industry experts is their understanding of equipment lifecycles and technological advances. They recognize that print jobs often fluctuate unpredictably, creating situations where you might need to quickly scale up your capabilities when demand increases.

Many businesses don’t realize they can take advantage of Section 179 of the IRS tax code when leasing equipment. This provision potentially allows you to deduct the full cost of qualifying equipment up to certain limits—creating substantial tax savings. (We always recommend chatting with your tax advisor about how these benefits apply to your specific situation.)

Here in Michigan, from our Grand Rapids headquarters to Detroit, Lansing, and Traverse City, we’ve seen how strategic equipment leasing helps printing operations stay competitive without depleting their capital reserves. The right leasing partner makes all the difference in keeping your print shop running smoothly while maintaining healthy cash flow.

Why Full-Service Printing Equipment Leasing Companies Stand Out

What separates the best printing equipment leasing companies from the rest? It comes down to several key offerings that address the unique challenges print businesses face.

100% Financing That Covers Everything

Unlike traditional bank loans that might demand hefty down payments, quality leasing companies typically offer 100% financing options. This means they cover not just the equipment itself but also those “soft costs” that add up quickly:

Installation, operator training, initial supplies, shipping, and software setup all get wrapped into your lease. For a complex digital press installation, these extras can add thousands to your investment. Having them included spreads these expenses over the term rather than requiring a large upfront payment that strains your budget.

Maintenance Bundles That Eliminate Surprises

Equipment maintenance is often the hidden cost that catches print shops off guard. Leading leasing companies offer maintenance bundles that combine equipment, service, and supplies into one predictable monthly payment.

Kyocera’s “Unlimited Plan” is a perfect example, providing an all-inclusive package with the equipment itself, all required toner, comprehensive maintenance, repairs, and even remote diagnostics to minimize downtime. This approach eliminates the uncertainty of fluctuating maintenance costs and ensures your equipment stays in top condition throughout the lease term.

Upgrade Paths That Keep You Competitive

Technology obsolescence is a major risk when purchasing printing equipment outright. Smart printing equipment leasing companies build structured upgrade paths into their agreements that let you trade up to newer technology at predetermined points, add complementary equipment as your business evolves, or adjust capacity based on changing volume requirements.

For print businesses where staying current with technology directly impacts your ability to compete, these upgrade paths provide tremendous strategic value. They ensure you’ll never be stuck with outdated equipment while your competitors race ahead with the latest innovations.

Want to learn more about how leasing can benefit your print operation? Check out our guide to Top Printer Leasing Benefits for a deeper dive into how the right leasing strategy can transform your business.

Essential Guide to Printing Equipment Leasing Companies

Vendor-Integrated Finance Partners

When you’re exploring printing equipment leasing companies, vendor-integrated finance partners offer a refreshingly simple approach to equipment acquisition. Think of it as a one-stop shopping experience – you select your equipment and arrange financing all in one seamless process.

These partnerships eliminate the traditional headache of juggling multiple providers. Instead of spending your valuable time coordinating between equipment vendors and separate financing companies, you work with a single point of contact who handles everything from equipment selection through financing approval.

“The biggest advantage we see is how much time our clients save,” notes one of our Kraft Business specialists. “When financing is embedded directly in the purchasing process, businesses can focus on finding the right technology solution rather than paperwork.”

This approach shines particularly bright when managing copier fleets and multifunction printer (MFP) deployments. Manufacturers like Kyocera partner directly with finance companies to create turnkey solutions that make equipment acquisition remarkably straightforward.

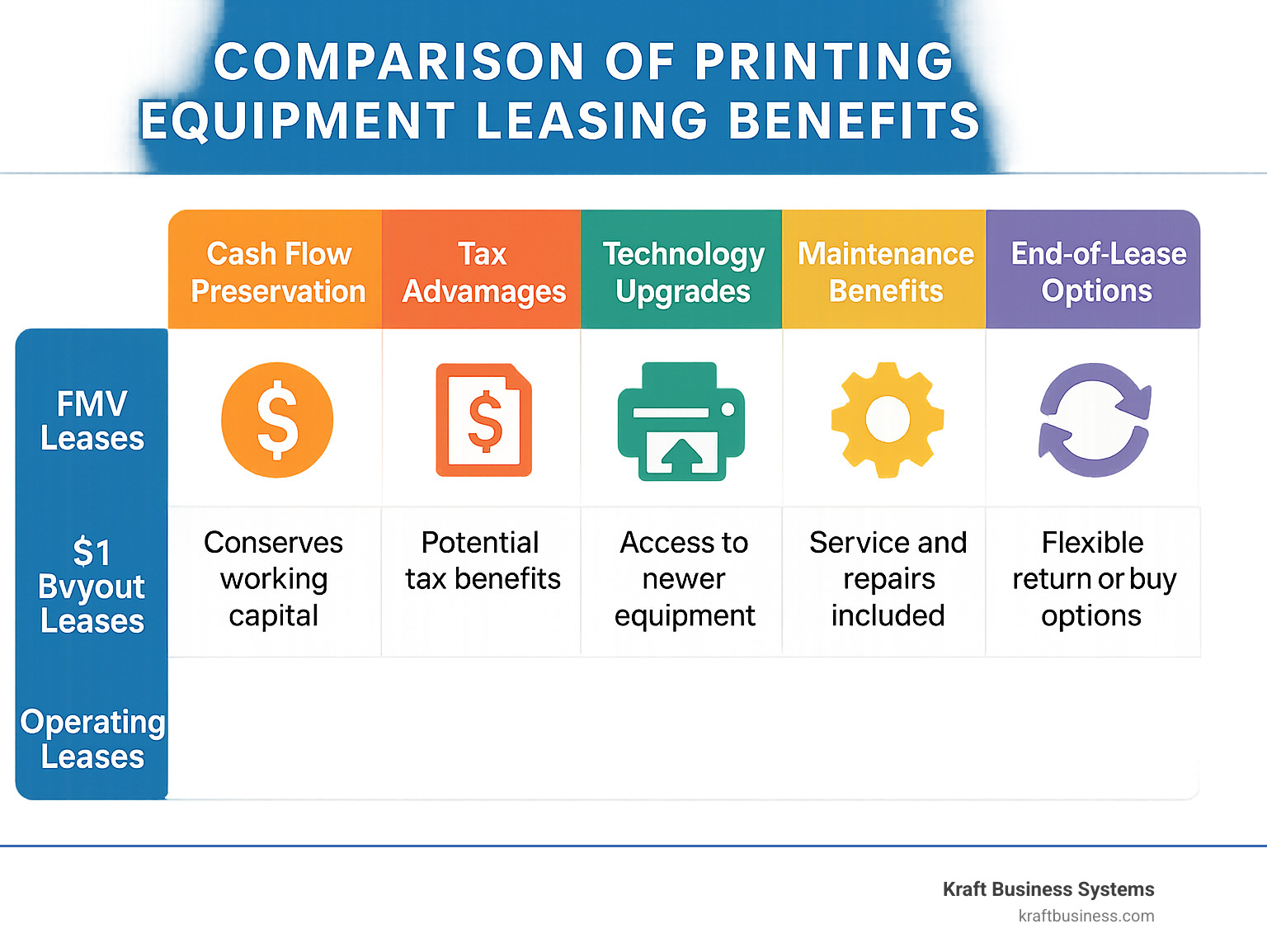

Fair Market Value (FMV) leases are particularly popular within these integrated programs. With an FMV lease, you’re essentially paying for the use of the equipment during your lease term rather than its full value. When your lease ends, you have options: return the equipment, purchase it at its current fair market value, or upgrade to newer technology. This flexibility proves invaluable as technology continues to evolve at lightning speed.

For businesses throughout Michigan – from busy Ann Arbor to growing Sterling Heights – vendor-integrated financing creates a smooth path to acquiring complete document management solutions. The Commercial Copier Leasing process becomes remarkably more straightforward when your vendor and financing partner work in perfect harmony.

We’ve seen how this integration reduces implementation time and eliminates the friction that often occurs when coordinating between separate equipment and finance providers. The seamless checkout experience means you spend less time on administrative tasks and more time running your business.

These partnerships often extend beyond simple financing to include industry-specific solutions. Healthcare practices might benefit from HIPAA-compliant document management features, while educational institutions can access programs with payment schedules aligned to academic fiscal years. This custom approach ensures you’re not just getting equipment – you’re getting a solution designed for your specific industry challenges.

At Kraft Business Systems, we’ve helped countless Michigan businesses steer these vendor-integrated options to find the perfect balance of technology and affordability without the usual acquisition headaches. The right partnership makes all the difference in creating a smooth, stress-free equipment acquisition experience.

Essential Guide to Printing Equipment Leasing Companies

FinTech Online Lease Marketplaces

The equipment leasing world has been revolutionized by financial technology, creating online lease marketplaces that make getting printing equipment faster and easier than ever before. These printing equipment leasing companies use smart technology to cut through the red tape that slowed down traditional leasing.

Take CMS Funding as a perfect example. They offer application-only leasing up to $150,000 with credit decisions typically coming back within just 24 hours. For print shops facing sudden equipment breakdowns or unexpected rush orders, this quick turnaround can be a business-saver.

What makes these FinTech platforms stand out is how they’ve simplified everything from start to finish. You’ll find digital applications that require minimal paperwork, e-signature options that eliminate printing and scanning documents, and online portals where you can manage your entire lease in one place.

“We needed to replace our digital press quickly after an unexpected failure,” shares one Michigan print shop owner. “The online application took less than 15 minutes, and we had approval the next morning. That kind of speed was unheard of just a few years ago.”

These platforms excel at financing both new and pre-owned printing equipment. If you’re looking to stretch your budget with quality used equipment, these marketplaces often have established connections with equipment resellers and can quickly put together financing that makes sense.

The Printer Lease Agreements you’ll find through these platforms typically use standardized terms that have been refined through thousands of previous deals. While you might have less room for customization, the trade-off is speed and simplicity that traditional leasing can’t match.

For businesses throughout Michigan—whether you’re in busy Detroit or smaller communities like Benzonia or Suttons Bay—these online platforms connect you to national lending resources that might not have offices in your area. This broader access helps level the playing field for businesses in all communities.

How FinTech Printing Equipment Leasing Companies Speed Approvals

The dramatic acceleration in lease approvals achieved by FinTech printing equipment leasing companies comes from smart innovations that completely rethink how leasing should work.

Soft-Cost Coverage Through Digital Estimation

Gone are the days of gathering multiple quotes for every little extra cost. Today’s FinTech platforms use clever algorithms that automatically calculate appropriate allowances for installation, training, shipping, and initial supplies. Their systems can quickly determine what your specific equipment setup will require without lengthy back-and-forth communications.

“The platform automatically added appropriate installation costs based on our equipment selection,” notes a print shop manager in Grand Rapids. “We didn’t need to track down separate quotes or estimates—it was all handled seamlessly.”

Credit-Matrix AI Decision Systems

Perhaps the biggest game-changer is how these platforms evaluate credit worthiness. Rather than just looking at credit scores and financial statements, their AI systems consider a much broader picture:

- How other similar printing businesses typically perform

- Patterns in equipment usage specific to your industry

- Seasonal cash flow fluctuations common in printing

- Economic conditions in your specific geographic area

- Your history with equipment vendors

By looking at this bigger picture, these systems can often approve applications that might get stuck in traditional credit evaluation. The AI continues learning from real results, getting smarter with each lease it processes.

For print shops facing tight deadlines, these innovations mean you could have funding in place the same day or next day—something that would have seemed impossible under old-school leasing models. We’ve helped clients across Michigan take advantage of these accelerated timelines when facing urgent equipment needs or sudden breakdowns.

At Kraft Business Systems, we can help connect you with the right FinTech leasing partner for your specific printing equipment needs, ensuring you get the benefits of these technological advances while still having a local partner you can trust.

Essential Guide to Printing Equipment Leasing Companies

Regional Boutique Lease Specialists

While national leasing companies offer extensive resources, regional boutique printing equipment leasing companies provide something special – they know your local market inside and out and offer relationship-focused service that many Michigan businesses find invaluable. These specialists blend financial expertise with a genuine understanding of what’s happening in your specific business community.

Regional leasing specialists typically maintain physical offices in specific territories, making in-person consultations and equipment inspections a regular part of their service model. For businesses across Michigan, this local presence means partnering with companies that truly understand the unique economic rhythms of different areas – whether you’re operating in the manufacturing-heavy southeast or the tourism-influenced northwest.

What makes these local specialists stand out is their ability to be flexible and responsive. When you call, you’ll likely speak with the same representative who knows your business history rather than reaching a different person each time. This relationship-based approach allows for more creative solutions custom to your specific printing needs.

Local expertise becomes particularly valuable when structuring payment plans. A regional specialist understands, for example, that a printer serving Michigan’s tourism industry might need seasonal payments – with lower obligations during slower winter months and increased payments during the busy summer season. This kind of flexible financing simply isn’t available through most national programs.

Another distinctive offering from these regional specialists is micro-ticket programs for smaller equipment purchases. Alliance Commercial Capital exemplifies this approach with their Micro Ticket Leasing Program covering transactions from $500 to $2,500 with terms from 6 to 24 months. These programs make it possible to finance smaller but essential printing equipment that might not meet the minimum thresholds required by larger leasing companies.

When you search for Copier Leasing Companies Near Me, you’re likely to find these regional specialists who maintain a physical presence in your community. At Kraft Business Systems, we’ve built strong relationships with regional leasing partners who understand the unique needs of businesses throughout our Michigan service areas.

Regional specialists also frequently maintain connections with local used equipment dealers. This network enables them to finance pre-owned printing equipment that might not qualify for national leasing programs. For smaller printing operations in places like Benzonia, Honor, or Suttons Bay, this capability provides access to cost-effective equipment solutions that might otherwise be out of reach.

The relationship focus these boutique leasing specialists bring means they’re often willing to look beyond just the numbers. They’ll consider your business history, growth plans, and local reputation when making financing decisions – something algorithm-based national companies simply can’t match. When you’re looking for a true partner rather than just a funding source, these regional specialists often provide the perfect balance of financial capability and personal service.

Essential Guide to Printing Equipment Leasing Companies

Bank-Backed Equipment Finance Arms

When your business needs the rock-solid reliability of established financial institutions, bank-backed equipment finance divisions deliver exceptional value. These printing equipment leasing companies bring together traditional banking stability with specialized knowledge of equipment financing that many growing businesses appreciate.

Bank-backed finance partners typically offer two main lease structures that serve different business needs:

Capital Leases (Finance Leases)

Think ofcapital leases as something closer to ownership from day one. While the bank holds legal title until you complete the lease, your business is treated as the owner for accounting and tax purposes. When you choose a capital lease, you’ll find:

The equipment appears on your balance sheet as an asset, strengthening your company’s financial position. Your lease payments split between principal and interest, similar to a loan. Your business claims valuable depreciation tax benefits, potentially improving your bottom line. You typically handle maintenance responsibilities, giving you control over equipment care. And when the lease ends, you’ll complete a nominal buyout (often just $1) to take full ownership.

Operating Leases

Operating leases work more like true rental arrangements, with the bank maintaining ownership throughout. This option offers different advantages, including:

The equipment stays off your balance sheet, which can improve certain financial ratios. Your lease payments become fully expensed, simplifying accounting. The lessor keeps the depreciation tax benefits, but this often translates to lower monthly payments for you. Maintenance might be included in your lease, reducing unexpected repair costs. At lease end, you have multiple options – return the equipment, purchase it, or upgrade to newer technology.

Beyond these standard structures, bank-backed finance arms offer specialized programs that solve unique business challenges. Progress funding helps when you’re investing in custom equipment built over time, with payments that align with construction milestones. Master lease lines act like pre-approved credit facilities, making it simple to add equipment incrementally without repeating the full application process for each new acquisition.

The Office Printer Lease Rates you’ll find through bank-backed programs often benefit businesses with solid credit histories. These institutions typically reward well-established companies with favorable terms that reflect their financial stability.

For Michigan businesses with substantial printing needs – perhaps you’re running a commercial print shop in Grand Rapids or managing a publishing operation in Detroit – bank-backed equipment finance arms provide the muscle needed for large-scale acquisitions. They excel at financing high-value equipment (frequently exceeding $150,000), setting them apart from many alternative funding sources.

Master lease lines prove particularly valuable as your business grows. Once established, these pre-approved credit facilities let you quickly access additional equipment as your needs evolve, without starting the application process from scratch each time. This streamlined approach saves considerable time when you need to expand your printing capabilities quickly.

At Kraft Business Systems, we’ve helped many Michigan businesses connect with the right bank-backed financing partners, ensuring they secure the printing technology they need with terms that support their long-term growth plans.

Essential Guide to Printing Equipment Leasing Companies

Conclusion

Navigating the landscape of printing equipment leasing companies requires understanding how different provider types align with your specific business needs. From full-service industry specialists to FinTech platforms offering rapid approvals, each category brings distinct advantages to the table.

The printing industry continues to evolve, with equipment sales approaching 1,000 units this year despite ongoing digital change. For businesses across Michigan, from our Grand Rapids headquarters to our service areas throughout the state, staying competitive means maintaining access to current technology without compromising financial flexibility.

Key considerations when selecting a leasing partner include:

- Industry expertise and equipment knowledge

- Financing structures aligned with your cash flow patterns

- Inclusion of soft costs like installation and training

- Maintenance and service integration options

- End-of-lease flexibility and upgrade paths

- Application simplicity and approval timelines

At Kraft Business Systems, we understand the critical role that printing technology plays in business operations. Our team of consultants and industry experts works with clients across Michigan to develop innovative, secure technology solutions that address unique business challenges.

Whether you’re a small business in Traverse City looking to finance your first multifunction printer or a large commercial operation in Detroit upgrading your production presses, we can help you steer the leasing landscape to find the optimal solution for your needs.

Leasing printing equipment represents a strategic approach to technology management that preserves capital, provides tax advantages, and ensures access to current technology. By partnering with the right leasing company, you can transform your printing capabilities while maintaining the financial flexibility needed to pursue other business initiatives.

For more information about printer and copier solutions, visit our dedicated resource page or contact our team to discuss your specific needs. We’re committed to helping businesses across Michigan print smarter, not harder.