AI Overview:

Governance risk is the hidden weak point that can destabilize even the most successful organizations. It arises when leadership, oversight, or ethical systems fail—leading to financial losses, reputational damage, or operational breakdowns. In a landscape where over $1 trillion is lost annually to poor governance, understanding and managing this risk is no longer optional.

Why Understanding Governance Risk is Critical for Modern Businesses

What is governance risk – it’s the potential for financial loss, reputational damage, or operational disruption that occurs when an organization’s leadership fails to make sound decisions, maintain proper oversight, or act with integrity. Simply put, governance risk emerges when the systems that guide how your business is run break down.

Quick Definition:

- Governance = The framework of rules, processes, and systems that control how your organization operates

- Risk = The uncertainty about consequences that could harm something your business values

- Governance Risk = When poor leadership decisions, weak oversight, or ethical failures threaten your business objectives

According to research from the Open Compliance and Ethics Group, over $1 trillion is lost annually due to unprincipled misconduct, mistakes, and miscalculations. That’s a staggering reminder of what’s at stake when governance goes wrong.

Think of governance risk like the foundation of a building. You might not see it every day, but if it’s weak or cracked, everything above it becomes unstable. Poor executive compensation decisions, data privacy failures, or ignoring environmental commitments can all create governance risks that damage stakeholder trust and hurt your bottom line.

For mid-sized businesses, governance risk often gets overlooked because it seems like something only massive corporations need to worry about. That’s a dangerous assumption. Whether you’re dealing with customer data, making strategic investments, or simply trying to maintain compliance with industry regulations, governance risk affects every decision your leadership team makes.

What is governance risk terms to remember:

What is Governance Risk and Why Does It Matter?

What is governance risk exactly? Think of it as the potential for things to go seriously sideways when your organization’s leadership, structure, and decision-making processes aren’t functioning properly. It’s not just about one bad decision – it’s about the entire system that guides how your business operates.

Let’s start with the basics. Governance is essentially the blueprint for how your organization is controlled and operates. It’s the system that determines how decisions get made, who has authority to make them, and how everyone stays accountable. As the Governance Institute of Australia puts it, governance encompasses “the mechanisms by which organizations and their people are held to account.”

Risk, on the other hand, is simply uncertainty about consequences – the possibility that something you value could be affected by events or decisions. Every choice your business makes carries some level of risk, whether it’s launching a new product or choosing a cybersecurity vendor.

When you combine these concepts, governance risk becomes the threat that emerges when your organization’s control systems, decision-making processes, and accountability structures fail or prove inadequate. It’s what happens when the guardrails that should keep your business on track either break down or were never properly installed in the first place.

Consider what can go wrong: Control systems might fail to catch fraud or errors before they cause damage. Decision-making processes could lack transparency or ignore critical information, leading to costly mistakes. Accountability structures might be so weak that nobody takes responsibility when things go wrong.

The difference between governance risk and traditional risk management is crucial to understand. Traditional risk management is like being a skilled mechanic – you identify specific problems (market volatility, equipment failure, cyber attacks) and develop targeted solutions. Governance risk management is more like being the architect who designs the entire garage – you’re focused on whether the overall framework for managing all those individual risks is sound.

While traditional risk management asks “What could go wrong with this specific process?”, governance risk management asks “Is our entire system for making decisions and managing risk actually working?” It examines whether your leaders are making sound choices about risk, whether your ethical standards are being upheld, and whether your organization can adapt when new threats emerge.

The stakes couldn’t be higher. Poor governance doesn’t just create inconvenience – it destroys value. Over $1 trillion is lost annually due to unprincipled misconduct, mistakes, and miscalculations. These aren’t random accidents; they’re often direct results of governance failures that could have been prevented with better oversight and decision-making structures.

When governance breaks down, the financial and reputational damage can be devastating. Companies face regulatory fines, legal battles, customer defections, and investor flight. The OECD Corporate Governance Principles provide an excellent framework for understanding how effective governance should function and why these failures are so costly.

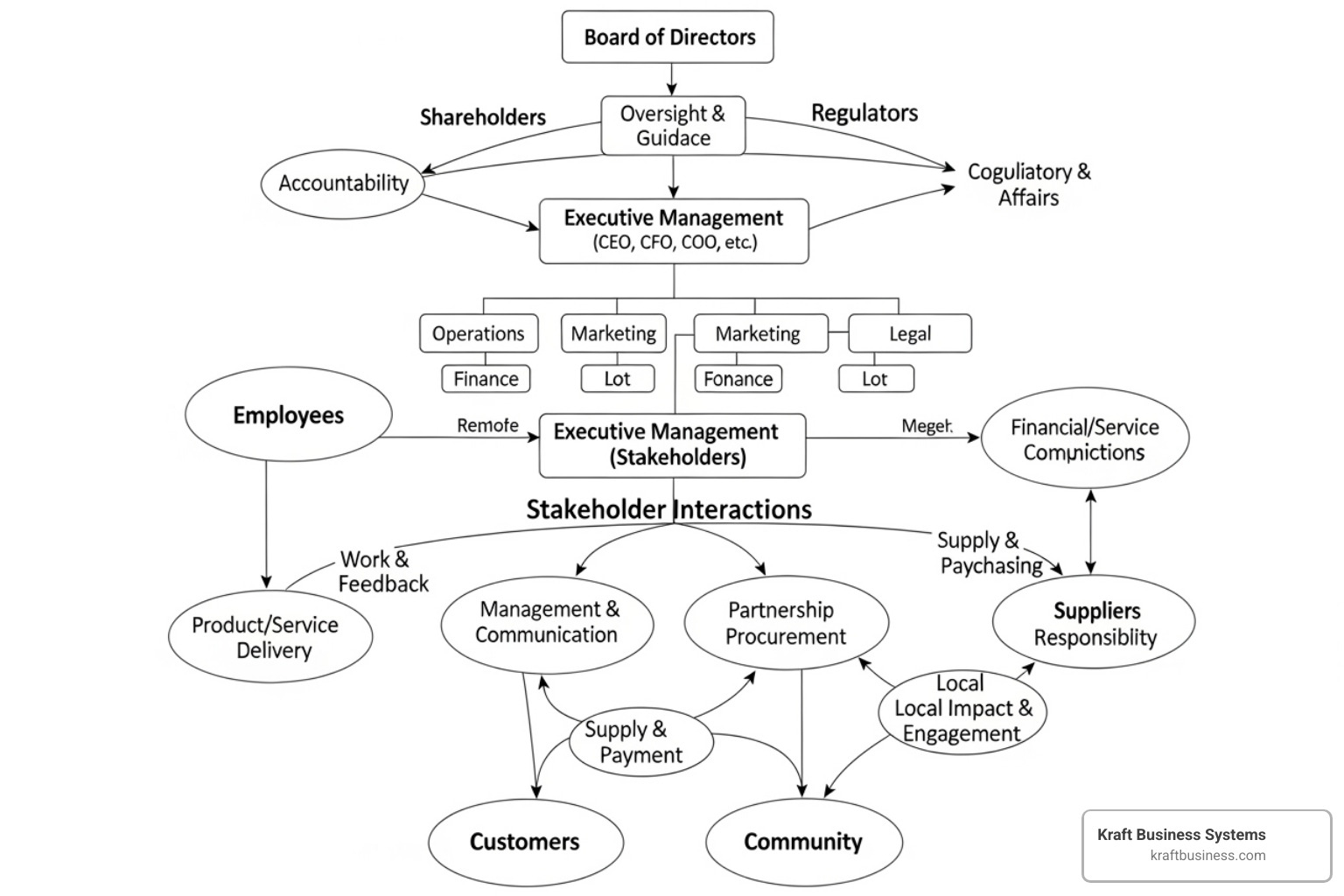

The Core Components of Governance

Effective governance isn’t a solo act – it’s more like a well-orchestrated symphony where every section has a crucial role to play.

At the top sits the Board of Directors, who serve as the ultimate guardians of your organization’s direction and integrity. They’re responsible for setting strategic course, overseeing management performance, and ensuring the company meets its legal and ethical obligations. The board’s effectiveness, independence, and composition directly impact how well governance risks are managed.

Executive Management takes the board’s vision and makes it reality through day-to-day operations. Your CEO and senior leadership team don’t just implement strategy – they shape the culture that determines how every employee approaches their work. Their decisions and behavior set the tone for whether integrity and accountability flourish or wither throughout the organization.

Shareholder Rights create another layer of accountability, especially when institutional investors actively engage with company leadership. Strong shareholder rights ensure that long-term value creation takes precedence over short-term gains that might increase governance risk.

The foundation of good governance lies in Internal Policies that translate high-level principles into practical, everyday guidance. These aren’t just documents gathering dust in filing cabinets – they’re living guidelines that help employees steer complex situations while maintaining ethical standards and regulatory compliance.

Perhaps most importantly, Ethical Culture determines whether all these formal structures actually work in practice. You can have the best policies in the world, but if your culture doesn’t value integrity, those policies become meaningless. A strong ethical culture means employees at every level understand your company’s values and feel empowered to act on them.

Finally, Transparency builds the trust that makes everything else possible. When you communicate openly with stakeholders about performance, challenges, and strategic decisions, you create an environment where problems can be addressed before they become crises.

Governance in the Context of ESG

The governance component of Environmental, Social, and Governance (ESG) often gets overshadowed by more visible environmental and social initiatives. But here’s the thing – the “G” in ESG is what makes everything else possible.

ESG governance goes beyond traditional compliance models. It encompasses how your leadership makes decisions that consider environmental and social impacts alongside financial returns. This broader view recognizes that stakeholder expectations have evolved, and long-term value creation requires balancing multiple interests, not just maximizing shareholder returns.

Think about it this way: a company might have a perfectly legal tax strategy that minimizes payments in local jurisdictions. From a traditional governance perspective, this could be seen as good financial management. From an ESG governance perspective, however, this strategy might create social tension and reputational risk that ultimately harms long-term value.

The board’s role in ESG has become increasingly critical as investors and regulators demand greater accountability for environmental and social performance. Directors must ensure that ESG considerations are integrated into strategy, risk management, and operational decisions. This includes overseeing accurate and transparent sustainability reporting, which faces growing scrutiny from stakeholders who want to verify that companies are walking the walk, not just talking the talk.

For organizations working with technology partners like Kraft Business Systems in Grand Rapids, ESG governance also means ensuring that your IT infrastructure and data management practices support your broader sustainability and social responsibility goals while maintaining the security and compliance standards that protect all stakeholders.

Common Governance Risk Issues Organizations Face

Today’s business landscape is a minefield of potential governance risks, evolving rapidly with technological advancements and increased public scrutiny.

Common issues include:

- Executive compensation: Concerns about excessive pay, “golden parachutes,” or a lack of alignment between executive pay and company performance.

- ESG inaction: Failing to follow through on environmental or social commitments, leading to reputational damage and investor backlash.

- Customer data usage and privacy: Mismanagement or breaches of sensitive customer information.

- Conflicts of interest: Situations where personal interests of executives or board members interfere with the company’s best interests.

- Lack of transparency: Hiding information or providing misleading reports to stakeholders.

- Regulatory non-compliance: Failing to adhere to laws and regulations, resulting in fines and legal action.

- Poor board oversight: An ineffective or disengaged board that fails to challenge management or provide strategic direction.

These issues are not just theoretical; they have real-world consequences. We’ve seen big tech companies called before the US Congress to explain how they capture and use customer data, underscoring the intense public and regulatory focus on these areas.

Governance risks also have a substantial influence on investment decisions, particularly within the fields of socially responsible investing (SRI), impact investing, and ESG funds. Investors employing SRI principles factor in governance considerations as a key component of their decision-making. (Source: CFA Institute). A company with weak governance is often seen as a riskier investment, regardless of its financial performance.

How does executive compensation relate to what is governance risk?

Executive compensation is a hot-button issue and a significant area of what is governance risk. When compensation packages seem disproportionate to company performance or average employee salaries, it raises questions about fairness, accountability, and board oversight.

- Pay-for-performance: If executive bonuses are not genuinely tied to long-term value creation or ethical behavior, it can incentivize short-term gains at the expense of sustainable practices.

- Golden parachutes: Excessive severance packages for departing executives, even after poor performance, can signal a lack of accountability.

- Pay ratio transparency: Disclosure of the ratio between CEO pay and the median employee salary can highlight disparities and prompt scrutiny.

- Shareholder approval: Many companies now seek shareholder approval for executive compensation plans to ensure alignment with investor interests.

- Alignment with company values: If a company champions social responsibility but its executives are rewarded for practices that contradict those values, it creates a significant governance risk.

- Reputational risk: Public perception of unfair or excessive executive pay can severely damage a company’s reputation and erode employee morale.

Transparency in executive compensation is often seen as a mirror image of a board’s perspective on pay equity and overall governance integrity.

Customer Data Usage and Cybersecurity Threats

In our increasingly digital world, customer data is a valuable asset, but its mismanagement represents a critical what is governance risk. Data privacy regulations like GDPR (General Data Protection Regulation) and HIPAA (Health Insurance Portability and Accountability Act) impose strict requirements on how organizations collect, store, and use personal information. Failure to comply can lead to hefty fines and severe reputational damage.

The threat of data breaches is constant and costly. According to IBM’s Cost of a Data Breach Report 2024, the global average cost of a data breach has hit an all-time high at $4.88 million, increasing by 10% compared to the previous year. (Source: IBM). This underscores the urgent need for robust cybersecurity.

Cyber-attacks are occurring every 39 seconds (Source: Forbes), making strong network security a fundamental business necessity. As Matthew Keeler, CEO of The KR Group, explains, “Cloud security is no longer optional—it’s a fundamental business necessity to protect sensitive data and ensure operational continuity.” (Source: Matthew Keeler LinkedIn).

C-suite executives and board members bear significant responsibility for establishing and enforcing internal policies and good governance practices related to customer data. This means investing in comprehensive managed cybersecurity services to protect against threats, implementing robust access controls like multi-factor authentication (MFA), and ensuring continuous monitoring of cloud environments.

The Impact of ESG Inaction

Making grand promises about environmental sustainability or social justice is easy; delivering on them is another story. The impact of ESG inaction is a growing what is governance risk. Companies that fail to meet their stated commitments face:

- Reputational damage: Stakeholders, including customers, employees, and investors, are increasingly sophisticated and will call out “greenwashing” or insincere social pledges. This can lead to a significant loss of trust and loyalty.

- Legal and regulatory consequences: As ESG reporting becomes more standardized and mandatory, failure to meet commitments or provide accurate data can result in fines and legal action.

- Investor scrutiny: ESG-focused investors actively seek out companies with strong ESG performance. Inaction or poor performance can lead to divestment or difficulty attracting capital.

- Employee disengagement: A workforce that feels their company isn’t living up to its values can become disengaged, impacting productivity and retention.

For example, if a company pledges to reduce its carbon footprint but continues to invest heavily in fossil fuels without a clear transition plan, it creates a governance risk due to the misalignment between stated values and actual practices.

Best Practices for Assessing and Managing Governance Risk

The difference between companies that thrive and those that stumble often comes down to one thing: whether they take a proactive or reactive approach to what is governance risk. Think of it like maintaining your car – you can either change the oil regularly and catch problems early, or wait until smoke starts pouring from the hood.

Too many organizations still operate with disconnected departments where compliance sits in one corner, risk management in another, and governance somewhere else entirely. This siloed approach is like having three different security systems in your building that don’t talk to each other – expensive, confusing, and full of gaps.

The solution? An integrated GRC framework that brings these functions together. When your governance, risk, and compliance efforts work as one unified system, you get better visibility, lower costs, and faster responses to emerging threats. It’s about getting the right information to the right people at the right time, so decisions are made with the full picture in view.

Best practices for assessing and managing what is governance risk

Managing governance risk effectively isn’t rocket science, but it does require discipline and the right approach. Here are the essential practices that separate well-governed organizations from the rest:

Establish a clear governance framework by defining exactly how your organization makes decisions and who has authority over what. This means spelling out the roles of your board, executive team, and key committees. Without this foundation, you’re building on quicksand. Resources like the OCEG GRC Capability Model provide excellent blueprints for getting this right.

Define roles and responsibilities so crystal clear that there’s no confusion about who owns what. From board members down to individual employees, everyone should understand their part in maintaining governance standards. When accountability is fuzzy, problems slip through the cracks.

Conduct regular risk assessments that look beyond just the obvious financial risks. Your governance risk assessment should examine internal processes, leadership effectiveness, and external factors that could impact your organization’s ability to operate ethically and effectively.

Foster a culture of integrity and accountability through consistent actions, not just pretty words on the wall. This means having clear codes of conduct, providing regular training, and most importantly, ensuring leaders model the behavior they expect from others.

Implement robust internal controls that act like guardrails on a mountain road – they keep you on track and prevent catastrophic mistakes. These might include financial approval processes, data access controls, or operational checkpoints that catch issues before they become crises.

Ensure transparent reporting to stakeholders because trust is built through consistent, honest communication. When stakeholders – whether they’re shareholders, employees, or customers – feel kept in the loop, they’re more likely to support you when challenges arise.

Use technology for monitoring and automation to handle the heavy lifting of tracking compliance, monitoring risk indicators, and maintaining documentation. Modern GRC software can transform what used to be a paper-heavy, error-prone process into something streamlined and reliable.

Overcoming Challenges in ESG Programs

ESG programs often start with the best intentions but quickly run into practical roadblocks that create their own governance risks. The biggest challenge many organizations face is simply keeping track of everything they’ve committed to do.

Creating one system of record is absolutely critical. When your ESG data is scattered across different departments, spreadsheets, and systems, it’s nearly impossible to get an accurate picture of where you stand. This fragmentation makes it difficult to track progress, identify gaps, and respond to stakeholder questions with confidence.

Collecting evidence to back up your ESG claims requires more than good intentions – it demands systematic data collection and verification processes. Without solid evidence, your sustainability reports become little more than marketing materials, and that’s a governance risk waiting to explode.

Framework selection can feel overwhelming with options like SASB, GRI, and MSCI all offering different approaches to ESG reporting. The key is choosing frameworks that align with your industry and stakeholder expectations, then sticking with them consistently over time.

Consolidating data for reporting becomes much easier when you have the right technology infrastructure in place. Connected ESG software can automate data collection, reduce manual errors, and generate reports that meet regulatory requirements without requiring a small army of people working nights and weekends.

The organizations that succeed in managing ESG-related governance risks are those that invest in robust IT infrastructure early in the process. They automate wherever possible, centralize their information, and provide real-time insights that allow leaders to make informed decisions about their ESG strategy.

At Kraft Business Systems, we’ve seen how the right technology solutions can transform ESG program management from a compliance burden into a strategic advantage. When your systems work together seamlessly, you can focus on actually improving your environmental and social impact instead of just trying to keep track of it all.

Frequently Asked Questions about Governance Risk

What is the difference between governance and risk management?

Think of governance as the steering wheel of your organization, while risk management is more like the brakes and safety systems. Governance is the overall framework of rules, practices, and processes an organization uses to direct and control its operations. It's what determines how decisions get made, who has authority to make them, and how everyone stays accountable.

Risk management, on the other hand, is the specific process of identifying, assessing, and mitigating potential threats to achieving your organization's objectives. It's more tactical and focused on what could go wrong and how to prevent it.

Here's a simple way to remember the difference: Governance decides how decisions are made and who is accountable, while risk management identifies what could go wrong and how to prevent it within that governance structure.

Governance sets the "tone at the top" for how risk should be managed throughout the organization. Without strong governance, even the best risk management processes can fall apart because there's no clear authority or accountability structure to support them.

Who is responsible for governance risk in an organization?

The honest answer? Everyone - but at different levels and with different responsibilities. It's like a relay race where each runner has a crucial part to play.

The board of directors carries ultimate responsibility and oversight. They're the ones who ensure the governance framework is sound and that management is actually implementing it effectively. Think of them as the final checkpoint for major governance decisions.

Executive leadership - your CEO and senior management team - are responsible for taking that governance framework and making it work day-to-day. They're the ones integrating risk management into daily activities and making sure what is governance risk gets addressed at the operational level.

Senior managers and department heads manage risk within their specific areas. Your IT manager handles technology governance risks, your finance director manages financial governance risks, and so on.

But here's what many organizations miss: every single employee has a role in upholding the organization's ethical standards and policies. When someone in accounting notices something that doesn't look right, or when a sales rep refuses to bend the rules to close a deal, they're actively contributing to good governance.

How does poor governance affect a company's value?

Poor governance is like a slow leak in a tire - you might not notice it immediately, but eventually, it'll leave you stranded on the side of the road. The impact on company value can be devastating and often happens in multiple ways simultaneously.

Direct financial losses are usually the first thing people think about. Regulatory fines, lawsuits, fraud losses - these can run into millions of dollars. Statistic about over $1 trillion lost annually to misconduct? That's not just theoretical; it's hitting real companies' bottom lines.

Reputational damage might be even more costly in the long run. Once customers, employees, and partners lose trust in your organization, it's incredibly difficult and expensive to win it back. Social media and online reviews mean bad news travels faster and sticks around longer than ever before.

Investor confidence takes a major hit when governance is weak. Investors - especially institutional ones - actively avoid companies with poor governance because they know it increases the likelihood of nasty surprises. This leads to lower stock prices and makes it much harder to raise capital when you need it.

Perhaps most importantly, poor governance creates an unstable environment where bad decisions become more likely. Without clear accountability structures and ethical guidelines, organizations drift toward short-term thinking and risky behavior. This undermines long-term profitability, sustainability, and growth potential.

The good news? Strong governance can actually become a competitive advantage, helping you attract better talent, more loyal customers, and more patient capital for long-term growth.

Secure Your Operations with Strong Governance

Throughout this guide, we’ve unpacked what is governance risk means for your business – from understanding how it differs from traditional risk management to exploring its critical components and the real challenges organizations face today. Whether it’s executive compensation decisions that don’t align with company values, customer data breaches that destroy trust, or ESG promises that never materialize into action, these risks are both varied and potentially devastating.

But here’s the thing: understanding and actively managing governance risk isn’t just about dodging regulatory bullets or avoiding embarrassing headlines. It’s about something much more powerful – building a foundation for principled performance that actually strengthens your business.

When you get governance right, you’re creating an organization that can reliably achieve its objectives, address uncertainty head-on, and act with integrity even when no one’s watching. That’s not just good ethics; it’s good business.

The change happens when you shift from reactive to proactive. Instead of scrambling to fix problems after they explode, you’re building systems that prevent them from happening in the first place. By adopting the best practices we’ve discussed – from establishing clear frameworks to leveraging technology for monitoring and automation – you’re not just checking compliance boxes. You’re changing governance from a burden into a genuine strategic advantage.

This proactive approach does something remarkable: it builds unshakeable stakeholder confidence. Customers trust you with their data. Investors see you as a stable, long-term bet. Employees feel proud to work for an organization that walks its talk. Your reputation becomes an asset that opens doors rather than a liability that closes them.

Your business becomes more resilient in an ever-changing world because you’ve built the internal strength to weather storms and adapt to new challenges.

At Kraft Business Systems, we understand that strong governance requires more than good intentions – it needs robust technological infrastructure to support it. Our team in Grand Rapids has helped businesses across Michigan implement the secure technology solutions and cybersecurity measures that make effective governance possible. From protecting customer data to ensuring compliance monitoring systems actually work, we provide the technical backbone that lets you focus on leading your business with confidence.

Don’t let governance risks undermine all the hard work you’ve put into building your business. The foundation matters, and it’s never too late to strengthen it. Contact us to learn more about our IT solutions and find how we can help you secure your operations and build a future of principled performance that your stakeholders can count on.