IT compliance risk management services help organizations meet regulatory requirements, protect sensitive data, and minimize security vulnerabilities through structured assessment, monitoring, and remediation processes.

| What IT Compliance Risk Management Services Include |

|---|

| ✓ Compliance gap assessments against frameworks (HIPAA, PCI, SOC 2, etc.) |

| ✓ Risk evaluation and prioritization |

| ✓ Control implementation and documentation |

| ✓ Audit preparation and support |

| ✓ Continuous monitoring and testing |

| ✓ Regulatory change management |

Managing IT compliance risks has become increasingly challenging for businesses of all sizes. With new regulations emerging constantly and cyber threats evolving daily, the pressure to maintain proper controls while running your business can feel overwhelming.

Financial institutions experience 2x cost savings when automating manual IT risk and compliance processes, yet many organizations still struggle with spreadsheet-based approaches that create audit fatigue and data silos.

“The world is risky, but it doesn’t have to be scary,” as one provider puts it. Modern IT compliance risk management services combine expert guidance with technology platforms to transform what was once an exhausting burden into a strategic advantage.

These services help you:

- Map your existing controls to multiple regulatory frameworks

- Identify gaps in your compliance posture

- Implement appropriate safeguards

- Monitor continuously for new threats and changes

- Report effectively to stakeholders and auditors

When properly implemented, compliance risk management becomes more than just checking boxes—it builds trust with customers, helps avoid costly penalties, and creates operational resilience.

It compliance risk management services terms at a glance:

What You’ll Learn

This guide is designed for business leaders, IT managers, and compliance professionals who need to understand how IT compliance risk management services can simplify regulatory obligations while strengthening security posture. Whether you’re based in Grand Rapids or any of our Michigan service areas, we’ll walk you through:

- The business case for investing in compliance risk management

- Essential components of effective IT compliance programs

- How automation and outsourcing solve common challenges

- Industry-specific considerations for your sector

- Methods to measure effectiveness and calculate ROI

- Emerging trends that will shape compliance requirements

By the end, you’ll have a clear roadmap for changing compliance from a cost center into a competitive advantage.

IT Compliance Risk Management Services: An Overview

Why IT Compliance Risk Management Matters

Let’s face it – the stakes for proper IT compliance have never been higher. When we look at the numbers, they tell a sobering story:

- The average cost of a data breach reached $4.45 million in 2023

- Regulatory fines can hit your bottom line hard (GDPR penalties can reach up to 4% of global revenue)

- 60% of small businesses close within six months of a significant cyber attack

But beyond these immediate threats, it compliance risk management services deliver strategic benefits that ripple throughout your entire organization.

Stakeholder Trust isn’t just a nice-to-have anymore – it’s essential. Your customers, partners, and investors want proof that you take security and compliance seriously before they’ll do business with you. One of our clients in Traverse City put it perfectly: “Our compliance certification opened doors to enterprise customers who wouldn’t have considered us otherwise.”

Business Resilience gives you staying power. We’ve seen it time and again – organizations with mature compliance programs bounce back from disruptions 1.7x faster than those without structured approaches. When (not if) something goes wrong, you’ll be ready.

Competitive Edge might seem like an unusual benefit of compliance, but it’s real. “Compliance provides a unique competitive edge,” as one industry leader notes. The smartest companies don’t view regulations as obstacles – they use compliance as a framework for operational excellence that sets them apart.

Governance Frameworks ensure your compliance activities align with business goals rather than existing in isolation. Think of governance as the backbone that supports everything else. IT Compliance and Governance establishes the foundation by clearly defining who’s responsible for what, and how everything gets reported up the chain.

Link Between Compliance & Risk

Understanding how compliance and risk management work together is crucial. While compliance focuses on meeting specific regulatory requirements, risk management takes a broader view of anything that might threaten your business objectives.

The Three Lines of Defense model shows how these functions complement each other:

- First Line (Operational Management): Your frontline teams handling day-to-day compliance activities and control implementation

- Second Line (Risk and Compliance Functions): The specialists providing oversight, monitoring, and guidance

- Third Line (Internal Audit): Your independent assessors validating that everything works as intended

We’ve seen that organizations partnering with Kraft Business Systems experience 10% improved efficiency when implementing this structured approach to compliance risk management.

Breaking down silos matters tremendously. “Institutions are 1.7x more effective when seamlessly sharing data across departments using integrated risk and compliance solutions,” according to industry research. When your enterprise risk management and compliance teams work from the same playbook, everyone wins.

Regulatory overlap creates headaches for many of our clients. Imagine a healthcare provider in Ann Arbor juggling HIPAA for patient data, PCI DSS for payment processing, and SOC 2 for service provider assurance. That’s a lot of overlapping requirements! It compliance risk management services help map these requirements to common controls, dramatically reducing redundancy and effort.

IT Compliance Risk Management Services: An Overview

Core Components of Effective IT Compliance Risk Management Services

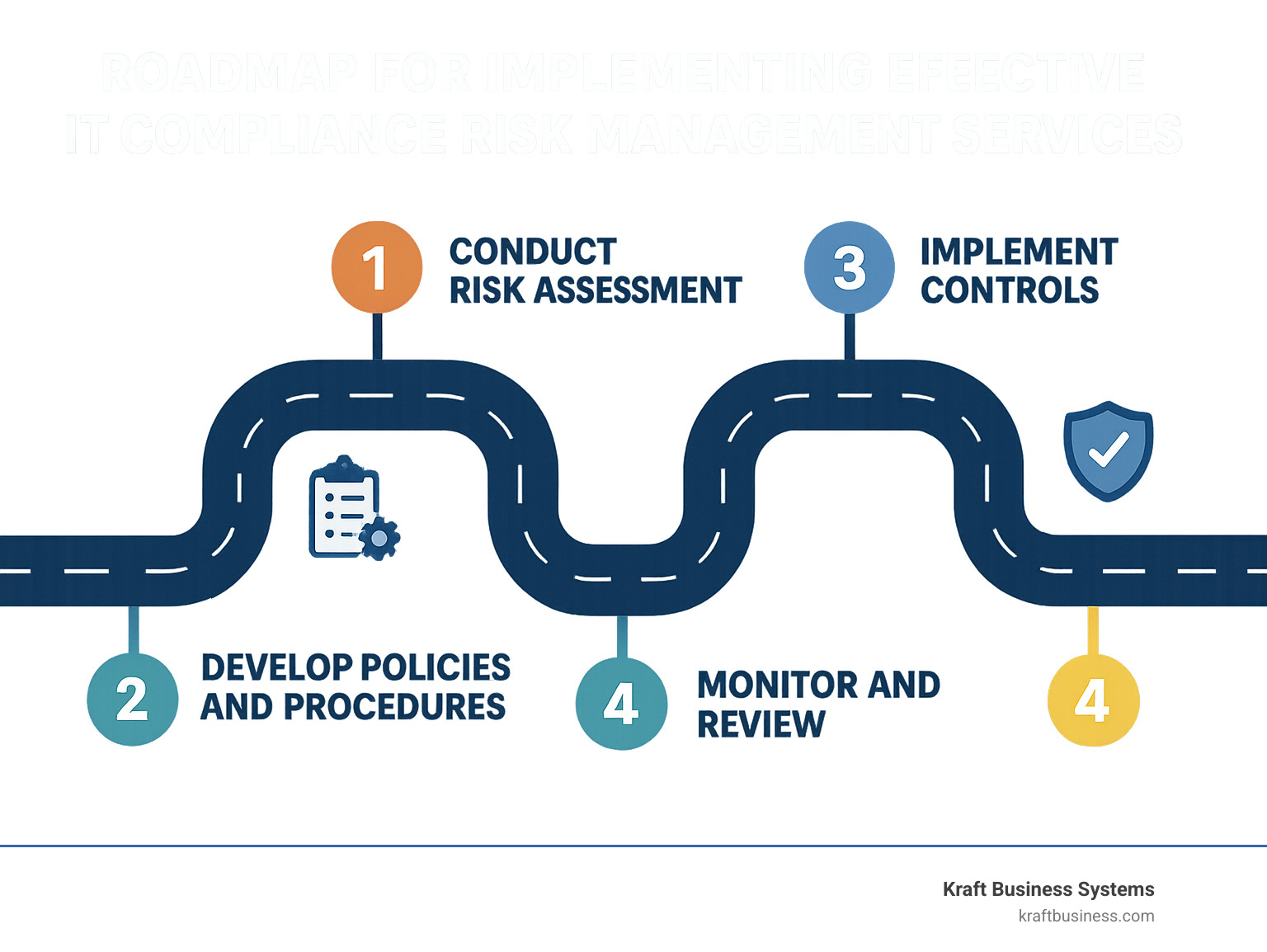

Looking at a well-designed compliance program is like examining the inner workings of a finely-tuned machine. Each component plays a vital role in keeping your business both secure and compliant. Let’s explore what makes IT compliance risk management services truly effective.

Risk Assessment

Every solid compliance program starts with understanding what you’re up against. Think of risk assessment as your business GPS – it shows exactly where you are and identifies potential hazards ahead.

When we worked with a manufacturing client in Michigan, their risk assessment revealed something surprising. Their biggest compliance vulnerability wasn’t in their main systems but in “shadow IT” applications that employees had installed without proper oversight. This findy alone potentially saved them from a significant data breach.

A thorough risk assessment includes mapping out your critical data assets, documenting which regulations apply to your business, weighing the likelihood and impact of various threats, and prioritizing these risks based on your specific business context.

IT Compliance Risk Assessment serves as your roadmap, ensuring you invest your time and resources where they’ll have the greatest impact on your security posture.

Control Framework

Once you know your risks, you need practical ways to address them. That’s where a control framework comes in – it’s your playbook for protection.

A well-crafted control framework does more than check regulatory boxes. It clearly defines who’s responsible for each control, documents exactly how controls should be implemented, establishes regular testing procedures, and – perhaps most importantly – maps controls across multiple regulations to minimize duplication of effort.

As one of our clients put it: “Before working with Kraft, we were reinventing the wheel for each compliance requirement. Now one control often satisfies three different regulations.”

Audit Readiness & “it compliance risk management services”

Nobody enjoys preparing for audits, but with the right approach, they don’t have to be painful. IT compliance risk management services transform audit preparation from a mad scramble into a smooth, predictable process.

Different frameworks come with their own unique challenges:

SOX 404 requires public companies to demonstrate effective controls over financial reporting, including the IT systems supporting financial processes.

SOC 2 focuses on how service organizations protect customer data according to specific Trust Services Criteria.

HIPAAmandates that healthcare organizations implement administrative, physical, and technical safeguards to protect patient information.

PCI DSS requires specific security controls for any business handling payment card data.

We recently helped a Detroit healthcare provider cut their HIPAA audit preparation time from three months to just three weeks through systematic evidence collection. As their CIO told us afterward, “This was the first audit where I actually got sleep the week before.”

IT Compliance Consulting Services can dramatically reduce the stress and workload associated with audit preparation, letting you focus on running your business instead of chasing documentation.

Continuous Monitoring in “it compliance risk management services”

The days of point-in-time compliance checks are fading fast. Modern IT compliance risk management services accept continuous monitoring – because security isn’t something you achieve once and forget about.

Continuous monitoring gives you real-time visibility into your compliance status, allows early detection of control failures, automates evidence collection, and helps identify trends before they become problems.

A financial services client in Lansing experienced this benefit when their continuous monitoring system flagged a critical access control violation within hours of occurrence. Had they relied on their old quarterly review process, this vulnerability might have remained open for months.

GRC: Governance, Risk, and Compliance Tools make continuous monitoring practical through centralized dashboards, automated testing, real-time alerts, and integrated workflows for fixing issues quickly.

As one client summed it up: “It’s like having a security guard who never sleeps and knows exactly what to look for.”

IT Compliance Risk Management Services: An Overview

Conquering Challenges with Automation & Outsourcing

Let’s face it – managing IT compliance is tough. Most organizations we work with at Kraft Business Systems struggle with the same problems:

Talent Gaps: Finding qualified compliance professionals feels like searching for unicorns, especially if you need specialized expertise in healthcare or financial regulations.

Manual Processes: We still see too many businesses tracking critical compliance activities in spreadsheets and emails. One client called their system “spreadsheet roulette” – never knowing if they had the latest version or if something important was falling through the cracks.

Siloed Data: When compliance information lives in different systems that don’t talk to each other, getting a complete picture of your risk becomes nearly impossible. As one of our Grand Rapids clients put it, “We had compliance islands with no bridges between them.”

Regulatory Change Fatigue: The constant barrage of new requirements and updates across multiple jurisdictions leaves many teams feeling overwhelmed and burned out.

The good news? You don’t have to tackle these challenges alone. IT compliance risk management services offer powerful solutions through automation and expert partnerships.

Technology Accelerators

Smart technology investments can transform your compliance program:

Workflow Engines eliminate tedious manual work by automating routine tasks like evidence collection and control testing. One of our Michigan manufacturing clients reduced compliance administration time by 62% after implementing automated workflows.

API Integrations create digital highways between your compliance platform and other critical systems – security tools, HR databases, IT ticketing systems – so data flows seamlessly without manual intervention.

Cloud Platforms enable your team to collaborate securely from anywhere while reducing infrastructure costs and maintenance headaches.

“Two-thirds of the nation’s top banks use automated platforms” for compliance management. These aren’t just nice-to-have tools – they’re changing compliance from a quarterly fire drill into a manageable, continuous process.

Information Security Compliance Tools provide the technological backbone that makes efficient compliance possible, cutting manual effort while boosting accuracy and visibility.

Benefits of Partnering

When you work with Kraft Business Systems for IT compliance risk management services, you gain several advantages:

Cost Efficiency: Access specialized expertise without the hefty price tag of full-time specialists. A mid-sized manufacturer in Flint saved approximately 40% compared to hiring dedicated compliance staff.

Scalability: Need extra help during audit season or after acquiring a new company? External partners flex with your needs without permanent overhead.

Faster Deployment: Why reinvent the wheel? Partners bring established methodologies and tools that get you up and running quickly.

Reduced Audit Fatigue: Experienced compliance partners streamline audit processes and minimize disruption to your core business. One healthcare client told us, “Last year’s audit consumed our entire IT team for weeks. This year, with Kraft’s help, most staff barely noticed it happened.”

Strategic Focus: Free your internal team to focus on growth and innovation rather than compliance paperwork. As one client put it, “We hired our IT team to move the business forward, not to become regulatory experts.”

“Employees derive more value from their roles when compliance is embedded,” notes one compliance leader. By partnering with experts, your team can focus on what they do best while maintaining confidence in your compliance posture.

Risk Management and Compliance partnerships can transform what feels like a burden into a business advantage – giving you peace of mind while creating operational efficiencies.

IT Compliance Risk Management Services: An Overview

Industry-Specific Considerations & Business Impact

Every industry faces unique compliance challenges. That’s why it compliance risk management services need to be custom to your specific sector and business needs. Let’s explore how these requirements vary across different industries.

Financial Services Deep Dive

Financial institutions steer some of the most complex regulatory waters:

Banks and credit unions in Michigan must comply with GLBA (Gramm-Leach-Bliley Act), which requires robust safeguards for customer financial information. The FFIEC Guidelines add another layer, setting clear expectations for authentication methods, business continuity planning, and third-party vendor management.

For publicly traded companies, SOX ITGC (Sarbanes-Oxley IT General Controls) demand rock-solid controls over financial systems. This means careful oversight of change management, access controls, and system development processes.

“When we partnered with a regional bank in Ann Arbor, they achieved double-digit return on capital within just a few months,” shares one of our compliance specialists. “We helped them rework their risk framework and balance sheet management practices in ways that satisfied regulators while actually improving efficiency.”

Financial institutions also face unique challenges with Model Risk Management – the algorithms and models used for lending decisions and financial forecasting need rigorous validation and oversight.

Effective Strategies for Managing Cyber Risk become especially critical in this sector, where customer trust is everything and regulatory scrutiny never sleeps.

Healthcare & PHI Protection

Healthcare organizations walk a tightrope when it comes to protecting patient information:

The HIPAA Security Rule isn’t just a compliance checkbox – it’s a comprehensive framework requiring administrative, physical, and technical safeguards for electronic protected health information (PHI).

Many healthcare providers in Michigan are adopting the HITRUST CSF framework, which harmonizes multiple regulations into a single, manageable approach. This is particularly helpful for organizations facing multiple compliance requirements.

The explosion of telehealth has made compliance even more challenging. A healthcare provider in Sterling Heights told us: “Our IT staff was able to focus on core duties when proactive notification and remediation were outsourced.” After implementing our it compliance risk management services, they reduced security incidents by 60% while expanding their telehealth services – proving that good compliance can actually enable innovation rather than hinder it.

The reality is that small and medium businesses face very different challenges than large enterprises. While bigger organizations might struggle with complexity and scale, smaller Michigan businesses often lack dedicated compliance resources altogether.

“We work with companies of all sizes in Grand Rapids and throughout Michigan,” explains our compliance team lead. “The key is right-sizing the compliance program to match your organization’s specific needs and resources.”

Manufacturing companies face their own unique challenges, particularly around operational technology security and supply chain compliance. Life sciences organizations must steer FDA regulations alongside cybersecurity concerns.

No matter your industry, a proper IT Security Risk Assessment custom to your specific requirements is the foundation of effective compliance management. At Kraft Business Systems, we’ve developed specialized approaches for each major industry in our Michigan service area, ensuring you get compliance guidance that actually makes sense for your business.

IT Compliance Risk Management Services: An Overview

Measuring Effectiveness, ROI & Future Trends

How do you know if your it compliance risk management services are delivering real value? It’s a question we hear often from our Michigan clients. The good news is that effective measurement doesn’t have to be complicated – it just needs to be consistent.

Smart organizations track both leading indicators (what might happen) and lagging indicators (what already happened):

Key Performance Indicators (KPIs) tell you if your compliance program is working as designed. Are your controls being tested on schedule? How quickly are you fixing issues when they pop up? What’s the severity of your audit findings? These metrics help gauge your compliance program’s maturity level.

Key Risk Indicators (KRIs) show you where trouble might be brewing. They include the number of security incidents you’re experiencing, any regulatory findings or penalties, patterns in control failures, and risk scores from your third-party vendors.

We’ve seen remarkable improvements when organizations mature their approach to compliance. Our clients typically enjoy a 50-70% reduction in audit preparation time, 30-40% fewer compliance-related incidents, and 25-35% lower compliance costs over time.

Calculating ROI on Compliance Investments

“But what about the bottom line?” you might ask. The return on investment for compliance comes from three main areas:

Avoidance Costs represent the money you don’t lose. One payment processor we worked with reduced their risk exposure by more than a third and slashed their expected loss by approximately 85% during a crisis. Those are real dollars saved through effective compliance management.

Efficiency Gains make your team more productive. Financial institutions typically experience double the cost savings when they automate manual IT risk and compliance processes. As one client told us, “We’re doing twice the compliance work with the same team.”

Revenue Enablement might be the most overlooked benefit. A software company in Detroit secured a multi-million dollar government contract after implementing our compliance program because they could finally meet the prerequisite security requirements. Compliance became their competitive advantage.

Emerging Regulations Shaping “it compliance risk management services”

The compliance landscape never stands still. Several important trends are reshaping what organizations need to prepare for:

AI Governance is no longer science fiction. New regulations are emerging around artificial intelligence use, demanding explainability, bias testing, and human oversight. If you’re using AI in your business, these requirements will affect you soon.

Data Privacy Evolution continues with regulations like California’s CPRA and updates to GDPR strengthening individual privacy rights. These changes require more sophisticated data handling practices from businesses of all sizes.

Climate Risk Disclosures are becoming mandatory as the SEC and other regulators implement requirements for climate-related financial reporting. This will require new compliance controls even for companies outside traditionally regulated industries.

Quantum Computing Preparedness sounds futuristic, but organizations need to start implementing quantum-safe cryptography as quantum computers begin to threaten our current encryption methods.

As one of our clients wisely noted, “A strong compliance function improves customer experience, brand loyalty, and stakeholder value.” We couldn’t agree more. By staying ahead of these trends, your organization can turn what feels like regulatory burden into genuine business advantage.

IT Compliance Risk Management Services: An Overview

Frequently Asked Questions About IT Compliance & Risk

How often should we reassess compliance risks?

The world of IT compliance isn’t static, and neither should your approach to risk assessment. While annual reviews were once considered sufficient, today’s rapidly evolving threat landscape demands a more dynamic approach:

Comprehensive assessments should happen at least once a year, giving you a complete picture of your compliance posture. Think of this as your annual health checkup – necessary even when everything seems fine.

Targeted reassessments become essential whenever significant changes occur in your business. This might include deploying new systems, acquiring another company, or experiencing a security incident. One of our manufacturing clients in Warren caught a major supply chain security requirement change during a quarterly reassessment – avoiding what could have been a costly compliance gap.

Continuous monitoring provides real-time visibility for your most critical controls and high-risk areas. As one client put it, “We sleep better knowing our most sensitive systems are being watched 24/7, not just checked once a year.”

Which frameworks work best for multi-regulatory environments?

Juggling multiple compliance requirements can feel like trying to solve several puzzles simultaneously. Here are the approaches we’ve found most effective for our Michigan clients:

NIST Cybersecurity Framework (CSF) offers remarkable flexibility and adaptability. Its risk-based approach makes it ideal for mapping across different regulations, creating a unified compliance strategy instead of siloed efforts.

ISO 27001 provides an internationally recognized foundation for information security management. Many organizations appreciate its structured approach and global recognition when working with international partners or customers.

Custom mapping approaches allow you to identify the common controls across multiple frameworks. This “map once, comply many” strategy dramatically reduces duplicate efforts. One of our Grand Rapids clients reduced their control testing workload by 40% after implementing a custom mapping solution.

“Our clients find that mapping common controls across frameworks isn’t just more efficient—it actually improves security by ensuring nothing falls through the cracks between regulations,” shares one of our compliance specialists.

When is it time to outsource compliance functions?

Knowing when to bring in IT compliance risk management services is a crucial business decision. Consider partnering with experts like Kraft Business Systems when:

Your team lacks specialized expertise in certain regulations. The complexity of HIPAA or PCI DSS requirements, for example, often warrants specialized knowledge.

Compliance activities are consuming too much of your internal IT team’s time. When your tech staff spends more time documenting controls than improving systems, it’s a clear warning sign.

You’re entering unfamiliar regulatory territory through new markets or offerings. A Traverse City client called us when expanding into healthcare, knowing HIPAA compliance was not something to learn through trial and error.

Recent audit findings have revealed gaps in your current approach. Sometimes an outside perspective is exactly what you need to address persistent compliance issues.

You need to mature your compliance program quickly due to customer requirements or business growth. Our team can implement proven methodologies that might take years to develop internally.

Outsourcing doesn’t mean abdicating responsibility—it means strategically leveraging expertise to strengthen your overall security and compliance posture. As one of our Detroit clients noted, “Bringing in Kraft’s team didn’t just fix our compliance issues; it freed our internal staff to focus on innovations that actually grow our business.”

IT Compliance Risk Management Services: An Overview

Conclusion

Effective IT compliance risk management services don’t have to feel like a burden on your business. When done right, they become a powerful advantage that helps your organization thrive in our increasingly regulated digital world.

At Kraft Business Systems, we’ve seen how Michigan businesses transform their approach to compliance from a reactive checklist to a proactive business strategy. Our clients consistently tell us how relieved they feel when compliance becomes manageable rather than overwhelming.

What makes the difference? It’s combining expert guidance with the right technology tools, creating a program that:

Meets regulatory requirements efficiently without excessive paperwork or disruption. One of our Detroit clients cut their compliance documentation time in half while improving their overall security posture.

Protects sensitive data through thoughtful controls that evolve as threats change. Your business and customer information is too valuable to leave vulnerable.

Builds genuine trust with customers and partners who increasingly expect proof of strong security practices before doing business.

Enables growth opportunities that would otherwise be closed off. We’ve helped numerous Michigan businesses qualify for contracts that required specific compliance certifications.

Reduces long-term costs through automation and efficiency, turning compliance from a drain on resources into a streamlined operation.

But perhaps most importantly, effective IT compliance risk management services help build a culture where security and responsibility become part of your company’s DNA. When every team member understands their role in maintaining compliance, your entire organization becomes more resilient and trustworthy.

Ready to transform your approach to IT compliance? We understand the unique challenges facing businesses throughout Michigan, from manufacturing firms in Grand Rapids to healthcare providers in Traverse City. Our team brings both local knowledge and deep technical expertise to every client relationship.

Explore our full IT solutions suite or reach out to discuss how we can simplify your compliance journey while strengthening your security posture. We’re here to help you steer the complex world of IT compliance with confidence, clarity, and maybe even a little less stress than you’re feeling today.

With offices throughout Michigan, including Grand Rapids, Detroit, Lansing, and Traverse City, Kraft Business Systems is your trusted local partner for turning compliance challenges into business opportunities.