AI Overview:

Compliance advisory services have evolved from a “necessary evil” into a strategic business asset. In today’s fast-changing regulatory climate—where HIPAA, GDPR, and other frameworks shift quarterly—these services help organizations not only avoid penalties but also turn compliance into a competitive advantage.

Why Compliance Advisory Services Matter More Than Ever

Compliance advisory services are professional consulting solutions that help businesses steer complex regulations, avoid penalties, and turn regulatory requirements into competitive advantages. These services include risk assessments, policy development, regulatory monitoring, and ongoing support to ensure your organization stays compliant with industry-specific laws and standards.

Quick Overview of Compliance Advisory Services:

- Risk Assessment & Management – Identify compliance gaps and vulnerabilities

- Policy Development – Create clear, actionable compliance procedures

- Regulatory Monitoring – Stay updated on changing laws and requirements

- Training & Support – Educate teams on compliance responsibilities

- Audit Preparation – Ready your business for regulatory examinations

- Technology Integration – Leverage tools for automated compliance management

Most organizations treat compliance as Thomas Edison once said about failure – “a necessary evil.” But here’s the thing: compliance doesn’t have to drain your resources while adding little value.

Smart businesses are flipping this script entirely.

Instead of viewing compliance as a bureaucratic burden, forward-thinking companies use it as a strategic advantage. They build trust with customers, streamline operations, and create competitive moats that protect their market position.

The challenge? Regulations are evolving faster than ever. HIPAA requirements keep expanding. GDPR impacts businesses worldwide. Industry-specific rules change quarterly, not annually. For mid-sized businesses, keeping up feels impossible without dedicated expertise.

That’s where compliance advisory services come in. They act as your regulatory GPS – helping you steer the complex landscape while turning compliance requirements into business strengths.

Simple guide to compliance advisory services terms:

- IT compliance and governance

- it compliance and risk management

- information technology audit services

What Are Compliance Advisory Services?

Think of compliance advisory services as a trusted guide for the complex world of regulations and legal requirements. We provide expert guidance to help businesses understand, meet, and stay ahead of the countless rules governing their operations. Instead of just pointing out pitfalls, we help you build a clear path forward, create safe operating procedures, and find opportunities along the way.

Our services focus on regulatory monitoring, risk assessments, policy development, and employee training to ensure your business is always prepared.

We work with businesses across many different sectors, including Healthcare, Finance, Technology, and Manufacturing, all of which have unique regulatory challenges. Whether you’re protecting patient data or managing financial transactions, compliance touches every aspect of your operations. For healthcare organizations specifically, ensuring IT Compliance for Healthcare is critical for patient safety and business continuity.

The Different Types of Compliance Advisory Services

Every business has different needs, so compliance advisory services come in several forms to match your situation.

Program Development is for businesses starting from scratch. If you’re launching a new company or entering a regulated market, we help build a complete compliance framework from the ground up, from risk assessments to policy development.

For established businesses, Program Reviews & Assessments offer a different value. We conduct mock audits and gap analyses to see how your current program measures up against today’s requirements. Our IT Compliance Audit Guide provides helpful insights into this process.

Many mid-sized companies find Outsourced Compliance to be their sweet spot. When hiring a full-time Chief Compliance Officer isn’t practical, we can act as your virtual compliance department, handling everything from daily tasks to strategic oversight.

Specialized Consulting tackles complex regulatory areas that require deep expertise, such as data privacy regulations like GDPR, cybersecurity frameworks, or anti-money laundering protocols.

Core Components of a Robust Program

An effective compliance advisory services program rests on several essential pillars.

Regulatory Intelligence: We use sophisticated monitoring systems to track regulatory changes that directly affect your business. This proactive approach lets you adapt to new requirements before they take effect.

Risk Assessment and Management: We assess the specific compliance risks unique to your operations and industry. Then, we work with you to develop practical strategies and controls to manage them. Understanding Risk Management and Compliance is essential for protecting your assets and reputation.

Policy and Procedure Development: We transform abstract regulations into concrete, actionable guidance your employees can use. We create policies that are both compliant and practical for your daily workflows.

Training and Communication: We ensure your entire organization understands their compliance responsibilities through custom training programs. Regular training helps build a culture where compliance becomes second nature.

The Strategic Value of Partnering with a Compliance Advisor

The smartest companies don’t just survive compliance—they thrive because of it. Partnering with the right compliance advisory services isn’t just about avoiding penalties; it’s about building a stronger, more trusted, and more efficient business.

- Building trust with customers and investors: A proactive approach to compliance signals reliability and integrity, which is crucial when data breaches are common.

- Improving operational efficiency: Well-designed compliance programs streamline operations by eliminating redundant processes, clarifying responsibilities, and creating workflows that prevent mistakes.

- Reducing risk of penalties and disruptions: Proactively managing compliance protects your business from hefty fines and operational disruptions that can halt business for weeks.

- Enhancing reputation and credibility: Companies known for ethical practices and regulatory excellence attract better talent, win more contracts, and build partnerships that drive growth.

The regulatory world is constantly changing, and what was compliant six months ago might be a vulnerability today. This is why compliance advisory services are a strategic advantage. We act as your navigators, translating complex legal text into clear business actions.

For example, when new data privacy regulations appeared, we helped a manufacturing client adapt by implementing new data handling procedures and training their team. This made their customer data more organized and accessible for legitimate business use. Read more about data privacy purposes to understand how these regulations are reshaping business operations.

The key is proactive alerts and strategic planning. We monitor proposed changes, analyze their impact on your business, and help you prepare in advance. This foresight allows you to implement changes smoothly, often before they become mandatory.

Integrating Compliance into Your Overall Risk Management Strategy

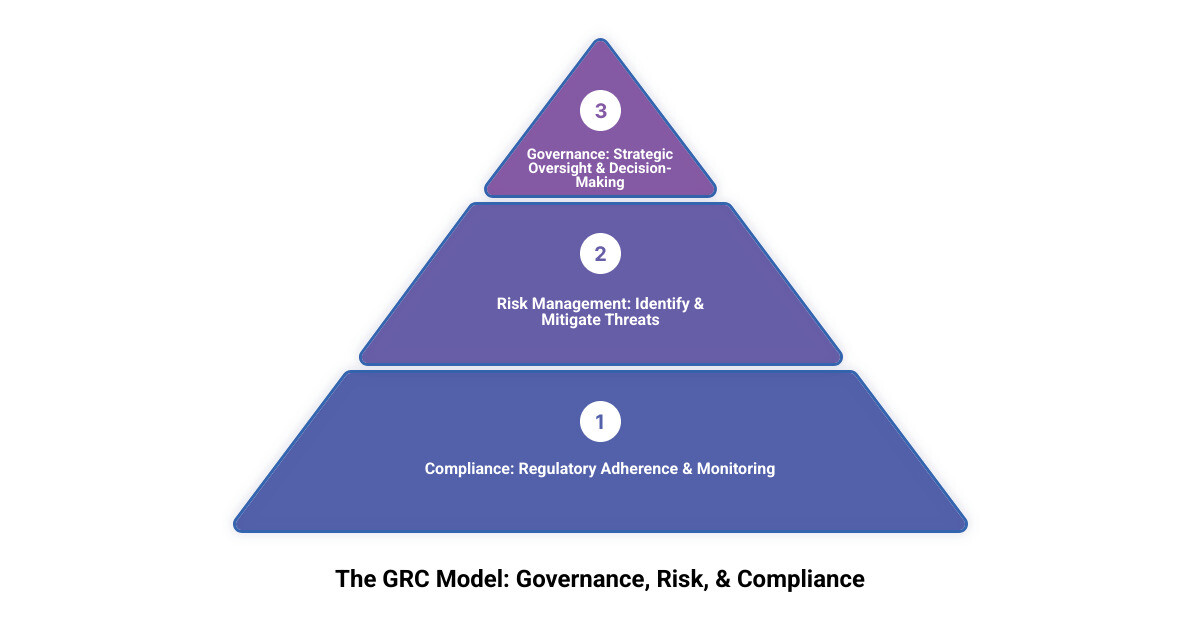

Compliance isn’t separate from other business risks—it’s woven directly into them as a key pillar of the Governance, Risk, and Compliance (GRC) Framework.

A compliance failure is never just a regulatory problem. A data breach, for example, creates reputational damage, financial losses from fines and lost customers, and operational disruption. We provide a holistic view of threats and opportunities, showing how strong compliance practices reduce multiple business risks simultaneously.

Successful businesses see compliance as an integral part of risk management. This integrated approach means every compliance improvement also strengthens their overall business resilience, turning today’s compliance investment into tomorrow’s competitive advantage.

The Role of Technology in Modern Compliance Advisory Services

Compliance used to mean drowning in paperwork, but the rise of Regulatory Technology (RegTech) has transformed how compliance advisory services operate. Instead of manual processes, intelligent systems make compliance smoother and smarter.

- Automation handles repetitive tasks like data collection and alerts.

- AI-powered monitoring sifts through regulatory updates to flag what matters to your business.

- GRC Compliance Software creates a centralized command center for all documents, policies, and audit trails.

- Data analytics identifies patterns and anomalies in your operations before they become problems, allowing for proactive intervention.

Leveraging Technology for IT and Cybersecurity Compliance

The link between IT and compliance is critical, as most modern regulations (HIPAA, GDPR, PCI DSS) focus on how you handle sensitive electronic data.

Technology provides the necessary tools for protecting sensitive data like PHI and PII, including encryption, access controls, and data flow monitoring. Securing networks and systems is also foundational, requiring that your infrastructure is properly configured, patched, and monitored. Our insights on IT Compliance and Security dive deeper into creating a robust security posture.

Technology enables sophisticated access controls, encryption, and comprehensive audit trails that regulators expect. These tools create an immutable record of who accessed what information and when. For many businesses, a Virtual CISO (vCISO) provides expert security leadership to manage this complexity without the cost of a full-time executive, an approach noted by Forbes for its effectiveness.

Preparing for Audits and Examinations with Tech

Technology turns a panic-inducing audit scramble into a well-orchestrated process. Using technology to streamline audit preparation transforms the experience, as shown in our guide on GRC Audit Management.

Centralized document repositories eliminate frantic searching by keeping all compliance documents in one secure, organized location. Automated evidence collection continuously gathers proof of compliance activities, such as access logs and training records, so you’re not scrambling for past evidence.

Generating reports for regulators becomes a matter of clicks, allowing for quick, accurate reports that demonstrate your compliance posture. The result is significantly reduced time and stress during audits, as you’re always prepared. Our article on how to Prepare for Your HIPAA Risk Assessment shows how this works in practice.

How to Identify the Right Compliance Advisory Partner

Finding the right compliance advisory services partner isn’t a one-size-fits-all decision. You need a firm that truly understands your business, not just a big name. The key is aligning the firm’s expertise with your specific industry and needs. A firm that excels with financial institutions might not be the best fit for healthcare regulations, and vice versa.

When evaluating potential partners, ask these key questions:

- What is your experience in my specific industry?

- How do you stay updated on regulatory changes?

- What technology do you use to support your services?

- How will you integrate with my existing team?

The best partners blend seamlessly with your operations, enhancing what you already have in place.

Evaluating Expertise and Experience

Expertise is essential when your business’s legal standing is on the line. Look for proof that a potential partner knows what they’re doing.

- Track Record of Success: Ask for specific examples and outcomes from businesses similar to yours.

- Expert Staff: Former regulators or industry experts on staff are game-changers, as they know how regulators think and what they look for during audits.

- Certifications: Look for industry-specific certifications that show a commitment to current standards.

- Testimonials: Case studies and client testimonials tell the real story behind a firm’s marketing. Look for specific results, not just generic praise.

Assessing Cultural Fit and Service Model

Beyond technical skills, you need a partner who fits your company’s culture. You’re finding a partner, not just a vendor. A true partner invests time in understanding your business goals and works collaboratively with your team.

Consider the firm’s service model. Do you prefer a personalized, hands-on approach or one that is more technology-driven? The best firms often combine both. Scalability and flexibility are also critical, as your partner should be able to adapt as your business grows and regulations evolve.

Most importantly, ensure they understand your business model and goals. Generic advice rarely works. The best partners provide custom solutions based on your specific operations and objectives. For example, effective Cybersecurity Consulting Management requires understanding your unique infrastructure and risks. The right partner becomes a trusted advisor who helps turn compliance into a competitive advantage.

Frequently Asked Questions about Compliance Advisory

What's the biggest mistake businesses make with compliance?

The biggest mistake we see businesses make is treating compliance as a one-time project instead of an ongoing process. It's like thinking you can change your car's oil once and never worry about it again.

Many organizations set up a compliance program, breathe a sigh of relief, and then essentially forget about it. They fail to continuously monitor, update, and adapt their program to new regulations and business changes. Here's the reality: the regulatory landscape is constantly evolving. What kept you compliant last year might leave you vulnerable today.

This static approach inevitably creates compliance gaps. When auditors come knocking or regulations change, these businesses find themselves scrambling to catch up. The result? Increased risk, potential penalties, and a lot of stress that could have been avoided with proper ongoing management.

Can't my internal team just handle compliance?

While it's certainly possible for an internal team to handle compliance, it's often more challenging than it appears on the surface. Think of it like doing your own taxes versus hiring a CPA - you could do it yourself, but should you?

Internal teams often face several key limitations. They may lack the specialized, up-to-the-minute knowledge of ever-changing regulations across multiple jurisdictions. Your IT manager might be brilliant at keeping your systems running, but do they know the latest HIPAA requirements or cybersecurity frameworks?

Compliance advisory services bring dedicated expertise that's their full-time focus. We have proven methodologies, industry connections, and an objective external perspective that internal teams may lack due to day-to-day operational demands. When you're buried in daily operations, it's hard to step back and see the bigger compliance picture.

An external advisor can provide fresh eyes, introduce best practices from across industries, and offer strategic guidance without internal biases or competing priorities. Plus, we're not asking for vacation time during your busy audit season!

How much do compliance advisory services cost?

The cost of compliance advisory services varies widely - much like asking "How much does a car cost?" It really depends on what you need and what features are important to your business.

Several factors influence the investment: the scope of services you require, the complexity of your industry's regulations, your company's size, and the specific expertise needed. A one-time risk assessment will cost very different from ongoing outsourced compliance support.

Our service options are designed to fit different budgets and needs. You might choose project-based fees for a specific task like a mock audit or policy development. Or you might prefer monthly retainers for ongoing outsourced support where we act as your virtual compliance team.

The key is finding the right balance between your needs and budget. A reputable compliance advisory firm will offer a custom proposal after an initial findy call, ensuring the services align with both your requirements and financial parameters. The goal is always to provide value that far outweighs the investment by mitigating risks, preventing costly penalties, and driving operational efficiency.

The cost of non-compliance - fines, legal fees, reputation damage, and business disruption - is almost always much higher than the investment in proper compliance support.

Conclusion

Compliance advisory services transform what many businesses see as a necessary burden into something far more valuable—a strategic advantage that actually strengthens your organization. Throughout this journey, we’ve explored how the right partnership can turn regulatory requirements from reactive scrambling into proactive planning that drives real business value.

The change is remarkable when you think about it. Instead of dreading the next regulatory update or audit notification, you can approach compliance with confidence. Risk reduction becomes systematic rather than accidental. Operational efficiency improves as streamlined processes replace chaotic workarounds. Your reputation strengthens as customers and partners recognize your commitment to doing things the right way.

The magic happens when human expertise meets technological innovation. Your compliance advisor brings years of specialized knowledge and industry insight, while modern RegTech tools automate the heavy lifting and provide real-time monitoring. It’s this powerful combination that makes compliance manageable, even in today’s rapidly changing regulatory landscape.

The right partner doesn’t just help you check boxes—they help you leverage compliance as a competitive differentiator. They translate complex regulations into clear business strategies. They turn audit preparation from a stressful ordeal into a smooth demonstration of your organizational strength. Most importantly, they free you to focus on what you do best: growing your business.

For businesses throughout Michigan and beyond—whether you’re in Grand Rapids, Detroit, Ann Arbor, or anywhere else—aligning your technology infrastructure with stringent compliance requirements doesn’t have to feel overwhelming. At Kraft Business Systems, we understand that effective compliance starts with secure, well-managed technology. Our custom IT and cybersecurity solutions ensure you have the technological foundation needed to support robust compliance programs while keeping you secure and ready for whatever the future brings.

The question isn’t whether you need compliance—it’s whether you’ll treat it as a burden or accept it as the business advantage it can become.